Inflation is hitting us all hard right now, and what makes it worse is that it’s a weird, technical subject like why fog happens or how bitcoin is made. Everyone is confused, a little surprised, and wondering “when will inflation go down?” It seems unfair.

In that spirit, this post will explain what’s going on, clearly, for humans, without math. Because women are smart enough to know that when Gas goes up to $7, we have a problem.

At the end, I’ll suggest how you can survive inflation, even if your teenagers are destroying your grocery budget. Let’s begin at the beginning.

Key Takeaways

- Learn the basics of what drives inflation, especially in 2022

- Inflation will likely last into 2023 and 2024, and could get worse, so it’s important to plan for the long term

- Specific money moves dictate how to survive inflation – increase your income and savings, and decrease your variable interest rate debt

What’s driving high inflation in 2022?

In a sense, today’s inflation was almost inevitable. Inflation in 2022 is a direct result of the unprecedented amount of cash that was injected into the economy – starting in response to the Great Recession in 2008 and more dramatically in response to the Covid-19 pandemic.

When the government transfers cash to people and businesses, consumers will have more money to spend on things. So sellers, not being stupid, will raise prices. This is measured in the Consumer Price Index (CPI) – changes in “inflation rates” are actually changes in the CPI, measured year over year.

This is, in fact, how it’s supposed to work and a little inflation is normal and expected. The movement of that one metric doesn’t mean those bailout decisions were wrong. (They should be judged on the myriad economic changes they made, both good and bad).

Think of high inflation as the side effects of taking antibiotics. The antibiotics prevent a recession from killing you, but you’re going to get diarrhea for a while.

How 2022 inflation drives high prices:

- We were all stuck at home for two years. To quote Her Financial Highness, Secretary of the Treasury and former Chairwoman of the Federal Reserve, Janet Yellen, “there’s been a dramatic shift in spending away from services toward goods and toward houses and food at home.” Fun story: in May 2020, I spent $165 on a used Flowbee on eBay. I had not cut my hair in 8 months and was desperate. Here is me the first time I used it, in my garage. It provided about half the haircuts to my neighborhood for over a year.

- The global supply chain went to hell. A lot of production and manufacturing shut down in 2020 and 2021, particularly in Asia where a lot of things are made. So stuff didn’t get made. That meant there was less of that stuff, and people would throw money at what was available. See the used Flowbee.

- We all learned to work remotely, so people are moving away from expensive places. Then, they drive up prices in their new home. For instance, Miami apartment rents have grown by 58% during the last two years, according to Realtor.com. That compares with a 19% national average increase in the same period. Those are both huge numbers, but they are still a deal to the people moving in.

- Russia went to war. Thanks, Vlad! Another major component of rising inflation for 2022 is gasoline prices, because one of the biggest exporters of oil and natural gas went to war and it FREAKED OUT the global energy market. There is a former KGB operative with nukes on the loose in oil pricing right now.

2022 INFLATION FORECAST

AskFlossie’s inflation forecast for 2022 is: don’t hold your breath. (Not financial advice – don’t sue me).

Why?

I don’t think Russia plans to leave Ukraine alone.

I don’t think people in Miami are going to turn around and decide they miss the poop on the street in San Francisco or the cost of housing in Manhattan.

I think the supply chain will take a long time to get ironed out.

The labor market, too.

I don’t think economic growth is going to tank. (As I said in the post on recession, if this is a banana, it’s a small banana.)

And I think people are finally, after decades of horrific wage suppression, holding out for more income at work or switching jobs to get it. And people with more money drive up prices.

SO, HOW CAN INFLATION GO DOWN?

Well, inflation can go down a couple of ways. The first is through central bankers’ intervention – the government can print less money (on paper or via electronic currency lent to banks), or raise interest rates to make it more expensive for people and companies to borrow money.

Raise Interest Rates

Higher interest rates have a cooling effect on prices. For instance, if your new mortgage has a 13% interest rate, as my parents’ did in 1977, you are going to buy a less expensive house or just keep renting. You have less purchasing power with higher inflation. Millions of people will make the same decision, and collectively, they will cool off the housing prices.

The Fed will make these moves gently, not only because being aggressive will lead us back to recession. But also because for the last 20 years, American people and companies have built their lives around a lower interest rate. The Fed’s 2022 target for their interest rate is 3.5%, and historically, that’s not that high.

TIME HEALS ALL SUPPLY CHAIN ISSUES AND EQUALIZES ALL MARKETS

The second way inflation goes down is organic, as people and businesses start making different choices when faced with high prices.

The Food Institute just did a great piece on how consumers are starting to make different decisions as food prices continue to rise. They cite a Vericast study that 27% of consumers changed their grocery store in the last 6 months to save money. In the last 6 months, 61% decided to dine out or order takeout less.

DOES INFLATION EVER GO DOWN?

Yes, absolutely. Inflation will go down when the factors driving it – weak supply chains, geopolitical instability, and high demand – reverse themselves.

To quote Janet Yellen, “I think you should see [inflation] as a consequence of recovery from a very severe shock due to the pandemic and something that will work itself out over time.” She’s been a little over-optimistic on inflation, but I think she’s right here.

Economists and financial experts aren’t wrestling with the question of “can inflation be reversed?” Instead, they are debating whether this is temporary inflation or long-term.

WHEN WILL INFLATION GO DOWN?

The truth is, no one knows. The Federal Reserve Bank hopes its policies will keep the 2020s from turning into the 1970s, as do other Central Banks.

A common rule of thumb has been a two-year time lag between monetary policy and inflation impact. So, about two more years of ugly. But that’s an average, that recent studies show more like 29 months, and highly variable.

Also, my husband points out that we’re talking about correlation here – the United States Central bank does something and 29 months later something else happens. That doesn’t mean they are related. Infuriating!

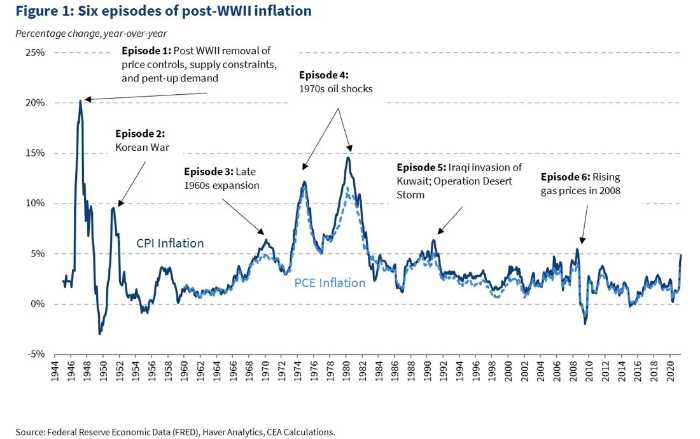

But we can make some guesses on how long this inflationary environment will last, based on history. Check out this cool graph from the White House blog. Note: it does not include 2022.

For me, this answers the question “when will inflation end” with “after a couple of years.” (And yes, you economic nerds, I know the question should be “when will high inflation end?”)

The other thing this graph shows me is that we’re all a little rattled because for an entire generation, inflation has been about as dramatic as Everyone Loves Raymond. This is everyone’s first high inflation rodeo. Gen-Xers and Millennials have NEVER seen anything like the high inflation in 2022. Boomers were really young in the 70s.

Including Jerome Powell, Chairman of the Federal Reserve Bank, who was 19 at the start of stagflation, fresh out of prep school. Almost no one in the workforce at the moment has directly experienced the effects of inflation or seen multiple inflationary periods.

WILL INFLATION GET WORSE?

It could. In fact, it probably will. Our family’s financial planning expects high inflation into 2024. (Lots of personal finance tips below to help you survive inflation1)

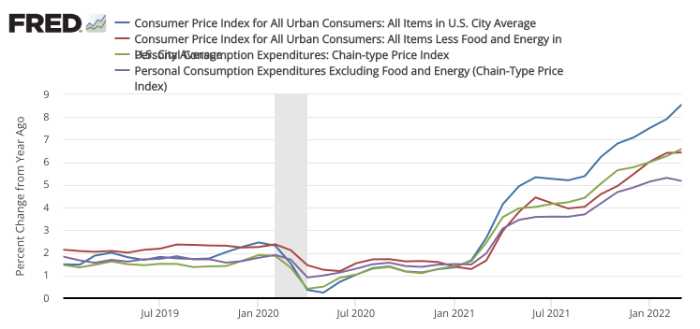

Here are the most recent three years of inflation data, as of March 2022, courtesy of the St. Louis Federal Reserve bank. The takeaway, we’re still on the upswing.

The rising cost of living

Rising costs for food, gas and rent especially are impacting families in real ways. In April 2022, food prices were up 9.4% over the past year, on top of 6.3% for the year before that. Let’s imagine you had teenage boys and over their freshman and sophomore years, your grocery bill went from $300 to $350/week. You’re out an extra $200 per month before you even drive them anywhere. For families on tight budgets, that’s a lot.

WHY IS THE COST OF LIVING SO HIGH?

The cost of living is too high, and people are starting to feel it. But why?

ENERGY PRICES AND GASOLINE PRICES

Back to Russia.

There are lots of complex global dynamics, but honestly, I think all the companies and countries that produce oil are not heartbroken that the Russian Bear is driving price increases.

Gas prices have been falling in recent years. Oil companies and oil-rich countries are thrilled, so they are going to be slow to counteract anything driving up the market… until election season. I bet you we will start seeing more moves in oil right before the midterm elections.

FOOD PRICES

The cost of food has gone up because of a few factors.

First: the companies that make the food can get away with charging more. Remember that influx of cash? They want some of it. Here’s a fun quote from Tyson’s CEO Donnie King, in a quarter where they increased beef prices by 23% and increased their profit margins by 18%.

“Tyson does not set the prices for either the cattle we buy or the beef our customers purchase. These prices are set by straightforward market forces, namely available supply and demand.”

Basically, he’s saying, if you don’t like the prices, stop paying them. By blaming price changes on raw materials and commodity prices, Tyson is misdirecting and padding its bottom line.

While most of what we spend on food goes into the cost of selling it to us, not the cost of growing it, the costs of agriculture products are up. The cost of fertilizers and pesticides has risen by 50% over the previous year thanks to the war in Ukraine. (Russia is a significant supplier of fertilizers.)

RENT AND HOUSING PRICES

The post-Pandemic migration has some downsides. People did not ask a bunch of Urbanites to drive up the cost of everything and are now expected to be good neighbors while absorbing major rent increases. This compounds the racial and cultural issues of gentrification.

So, why are rents so high? Well, here is a picture of San Francisco from 2018. It has gotten (much) worse since then.

People have lived in places like New York and San Francisco, because of the career opportunity and like-minded community. Prior to the pandemic, there was such a talent drain out of small cities and towns, at least half of my high school class left.

People have lived in places like New York and San Francisco, because of the career opportunity and like-minded communities. Before the pandemic, there was such a talent drain out of small cities and towns, at least half of my high school class left.

Enter remote work.

Now, anyone (liberals, queers and ambitious women) can find a community and employment from anywhere. Paying $2000 a month for a bedroom with no windows isn’t a requirement to have the career you want. And it’s much easier to access community online than it was 20 years ago.

These migrators are creating price pressures everywhere. After San Francisco or Manhattan, everything seems cheap.

WILL PRICES GO BACK DOWN?

In the long run, no. When inflation drops, prices don’t fall. Prices just stop going up so dramatically. We might see some little price blips along the way, and there may be a period of deflation, where prices go down, but those blips will be temporary.

However, in some cases, the prices of goods may go down. Historically, manufacturing moving overseas and improvements in technology have lowered electronics costs. The laptop I am typing this on was about half the price of my first laptop, purchased decades ago. Clothes are much cheaper.

But gas is six times more expensive than it was back then, and to get Clinique Black Honey Almost Lipstick, which half of America has been wearing since the 80’s because it looks good on everyone, you basically have to sell a kidney. Thanks, TikTok.

The Federal target is for prices on everything, on average, to go up ~2% per year.

How to Prepare for Inflation (In 2022 AND BEYOND)

Like Biden and the Russian Bear, you can’t control it, but you can control how you respond. And you can respond.

INCREASE YOUR INCOME

Why is Amazon paying to advertise maternity benefits for hourly workers? Not because they love women. Because in April 2022, the unemployment rate was 3.6%, which gives workers a tremendous amount of negotiating power.

Now is the best time in recent history to look for a new job or take on a side hustle, so far even despite layoffs. If you choose a job, pick one with a raise or promotion path. If you get a second job, make it an effective way to earn money now and aligned with your goals.

ADJUST YOUR BUDGET FOR RISING PRICES

Beef is not going to get cheap overnight, so if you are a budgeter, it’s a good idea to revise. Pay close attention to different categories: energy prices, grocery prices, and the price of housing.

Build your emergency fund

Emergency funds are war chests in times of recession. If you don’t have an emergency fund, now is a good time to start one. Begin with $20 or $50 or 100 and increase the amount every month until you reach your goal. A simple way is to automate it. I know this is tough in an inflationary environment with higher costs, but every little bit helps.

FRUGAL MUSCLES Survive Inflation

If you’re not a budgeter, high-five me neither. Just try to focus on your spending and align it to your values. Going to the grocery store is going to hurt for a while. Inflation is likely to continue to rise, so the best thing you can do is start paying attention now and develop the frugal muscle. It will serve you well when things turn around.

HOLD OFF ON MAJOR PURCHASES, IF YOU CAN

It’s not a great time to buy cars or appliances, to move house (whether you rent or buy) or to renovate an existing home. Fun story, we recently finished renovating our house. I forgot one door in the original order in spring 2021. The door I just purchased was identical, and cost four times as much. Hold off if you can.

AVOID NEW DEBT

When the Fed raises rates, it does so for everyone – banks, companies and consumers. That means a new credit card, car loan, mortgage, or personal loan is going to be higher than in recent years.

You especially want to avoid variable interest rate debt. If the Fed responds to higher prices by dramatically increasing rates, variable rates will go up as well. HELOCs, credit cards and other debt that changes rate quickly will be hardest to predict.

PAY DOWN VARIABLE RATES FIRST

If you have a low fixed-rate mortgage or student loan, paying it off right now is not a (mathematical) priority. Instead, pay down any variable rate debt, such as variable mortgage rates, credit card debt or a HELOC. That will give your budget some stability while inflation goes nuts.

ADJUST YOUR INSURANCE COVERAGE

A lot of property insurance policies (home, car, renters, etc.) include assumptions about replacement costs that may or may not be correct. It’s worth a little research and a call to your insurance agent (or call center) to make sure you have enough coverage.

ADJUST YOUR RETIREMENT ASSUMPTIONS

Inflation eats away at the value of your long-term investments. Let’s avoid the high school math on this and do some napkin math: Take your long-term investment rate of return (say 10% for the stock market) and subtract your average annual inflation rate (say 3% over your lifetime). You have a 7% real annual rate of return.

That real rate of return reflects how far your money will actually go in retirement, taking inflation into account. When inflation is higher, it reduces your real rate of return even further.

Knowing this may lead you to save more and/or revise your retirement planning assumptions. This is worth reviewing annually.

INVEST EXTRA MONEY to Beat Inflation

Stock prices are volatile and low right now. Which makes it a great time to hitch up your pants and dollar cost average into the market!

In the example about the real rate of return, we used the stock market average. This impacts savings account rates too. The average savings account interest rate (as of May 2022) is 0.06%, or almost zero. High interest savings accounts are around 1%. Inflation is at 8.3%.

Best case scenario, your savings are worth 7.3% LESS than last year. The low interest rates from savings accounts won’t cut it.

Stocks have had a rough year, but on average over the long haul, they beat high inflation. Small investments in mutual funds and index funds are easy to automate and inexpensive. In the long term, they will pay off.

Surviving Inflation

I hope this has helped. These are unprecedented times for three generations of American women, so if you’re feeling uneasy, you’re not alone.