(Updated April 2022)

Debt is a stressful topic for anyone, but having been single with a mortgage and student loan debt, it’s a little harder on single women to beat debt. Not actually harder, just harder emotionally. You already have a lot on your plate, you’re just one woman, it can feel like a long road to get to your money goals.

But single women are the mistresses of their own destinies: you can pick your debt strategy and financial goals, and break down your credit, car, or student loan debt, until you’re financially free. Even if you’re a single parent, battling the gender pay gap or dealing with domestic violence and financial abuse.

First, an important question about your relationship with control:

Key Takeaways

- How to beat debt? Increase your income through a side hustle, raise, or new job. Women are underpaid, and no amount of saving will compensate for that.

- Car loans and student loans are necessary evils, so focus on keeping them minimal and paying extra to put them behind you.

- Don’t borrow from your future! 401k loans are notorious for fees and taxes upon your withdrawal.

ARE YOU A SNOWBALL OR AN AVALANCHE WOMAN?

When it comes to debt advice, there are two main strategies. Both are equally effective, and ask the question: which account any available money ABOVE the minimum payment?

THE SNOWBALL DEBT METHOD

Using this method, you list your debts in order from smallest to largest and start with the smallest debt. Then the next smallest, and so on. Personally, I love the small feeling of success that comes from crossing an item off of my to-do list. If you’re like me, the snowball method may be for you.

By starting with the smallest debt, you can quickly feel like you’re making progress in improving your life. This is the best method if your debt all has the same/similar interest rate. The downside? Your smallest balance may not be your highest interest rate, and paying that interest rate hurts.

THE AVALANCHE DEBT METHOD

To overcome debt using the avalanche method, you organize your debts by interest rate, and make extra payments on the debt with the highest interest rate first. Some women are optimizers. They want to pay as little interest as possible, and won’t feel discouraged if it takes longer . If that sounds like you, try the avalanche method.

This is also good if, like many women, you enjoy sticking it to the financial system. “Tricked me once, but you’re not getting a dime more in interest!” With the avalanche method, you’ll likely target personal loans and credit cards first, then car loans and student debt, which have lower interest rates.

There is another way: peanut butter. Spread any extra money around everywhere you owe money and rejoice in everything getting nibbled away at. This never worked for me. It lacks the moral victory over banks of the avalanche method, and the sweet victories of the snowball.

#1 WAY TO BEAT DEBT? INCREASE YOUR INCOME

Many single women say that their biggest financial challenge is not earning enough, and they can’t work a second job due to their family commitments – I want to honor that. I have worked second jobs because I didn’t make enough to live on 9-5. I was young and didn’t have kids, and it was physically exhausting.

BUILD INCOME WITH A SIDE HUSTLE

Even if it seems out of reach, think creatively. If you’re trying to pay off debt any financial boost will help a lot, even a small one.

There are lots of different kinds of side hustles, and some of them are very lucrative! Clever Girl Finance has a great guide. (Not a paid link – we just like CGF!)

OTHER OPTIONS FOR ADDITIONAL INCOME

If your schedule is already packed, you could sell things you no longer need on eBay, or rent out a spare room in your home.

Women with more time on their hands could do online work, teach English online (you don’t need a teaching license), become a Virtual Assistant, or join a gig company which can be done from your home.

SIDE HUSTLE INCOME = TAX BENEFITS

One tax bonus: if your side hustle has associated costs, they may be deductible expenses. Commuting between jobs, or mileage on your car while your driving lift are deductible. Do a little research!

DON’T BORROW YOUR WAY OUT OF DEBT

You want to get out from under your debt as soon as possible; that’s great! However, there are a few techniques that may seem beneficial that are actually dangerous to your financial well-being. Here are some ways to overcome debt you should run away from:

401K LOANS

Don’t borrow from your future! 401k loans are notorious for fees and taxes upon your withdrawal. This is an “only in an emergency” situation. In 2020, the number of withdrawals from 401ks dropped 23%, according to Vanguard.

(Source: Vanguard 2020, https://institutional.vanguard.com/content/dam/inst/vanguard-has/insights-pdfs/21_TL_HAS_InsightsToAction_2021.pdf#page=11)

HOME EQUITY LINE OF CREDIT

If you borrow money against your home, but default, you could lose your home. Also, HELOCs don’t have great interest rates.

DEBT SETTLEMENT COMPANIES

For a fee, these companies claim to contact your creditors and reduce what you owe, but they rarely follow through with this promise. You can negotiate on your own behalf. Check out Shonda Martin @RoadTo750Plus on Instagram for a lot of great free debt settlement content.

PERSONAL LOANS / PAYDAY LOANS / SHORT TERM LOANS

Personal or payday loans have extremely high interest rates, sometimes without a grace period. You could end up owing more in interest than the amount you borrowed. If you are in a dire cash crunch, alternatives to personal loans are a cash advance on your credit card debt (usually a high interest rate, but not time bound), or extending the overdraft protection loan from your bank. If you are considering a payday loan, it’s a sign you need to ask for help from friends and family.

(Source: Value Penguin https://www.valuepenguin.com/loans/average-loan-interest-rates)

CAR TITLE LOANS

A car title loan is short-term, high-interest debt that uses your car as collateral. The lender can repossess your car if you don’t make payments. The risk here isn’t that you will lose your car (you could, but only about 10% of people who take out title loans lose their car). The risk is the average 300% interest rate. That means you owe four times what you need to borrow, and typically make payments in a month. That is like digging a hole three times deeper… to get out of a hole.

DEBATABLE: CASH ADVANCES

This one is controversial, on one hand it could help you use credit carefully and as a one-time thing. On the other hand, it could make your debt and credit score much worse. I did this a couple of times early in my money journey, to make rent or bills I couldn’t put on credit. Not a proud moment, it was a “break glass in case of emergency” move.

A cash advance is taking out cash from your credit card, typically through an ATM. The interest rate is high, and there is often no grace period. You start owing interest immediately. But unlike a payday loan, it’s not a fixed term, which gives you more flexibility. It’s just going to build interest until you pay it off, and if you let it run, you could end up with more in interest than the amount you borrowed.

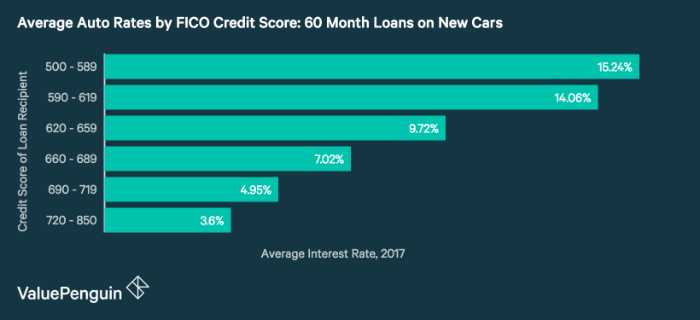

CAR LOANS – A NECESSARY EVIL FOR WORKING WOMEN

Sometimes you need a car to get to work, or to keep your job. If this is the case, and you absolutely cannot afford the car outright, then get the shortest term you can qualify for. The shorter the loan term, the less interest you will pay in the long run.

You should also put money down when you purchase the car. The more money you put down, the less money you will have to finance, and the less interest you will pay.

There is no shame in driving and maintaining a used Camry that you could afford to buy without a loan. One of our cars is a Honda we bought used, after a lot of bargain shopping. Is it glam? No. But it allowed us to keep low monthly costs when we had other financial priorities, like buying a house and welcoming a kid to our family. It sucked having one car, but later when things had stabilized, I bought a nicer second car. Her name is Spicy.

(Source: Value Penguin https://www.valuepenguin.com/loans/average-loan-interest-rates)

HOW TO PAY OFF CAR LOAN FASTER

You can make extra payments on your car loan to pay it off faster. You can also refinance your car loan to get a lower interest rate and/or a shorter term. Be mindful that refinancing any debt comes with fees, and will extend your term. Not always a good idea when cars are worth less every year.

WOMEN AND THE STUDENT LOAN DEBT CRISIS

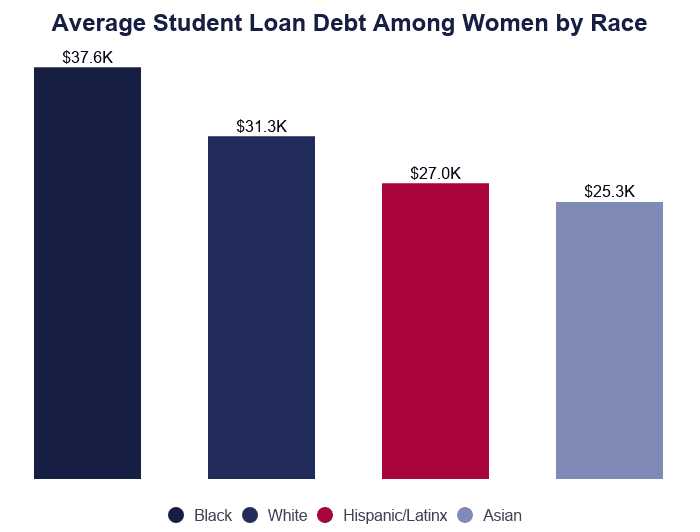

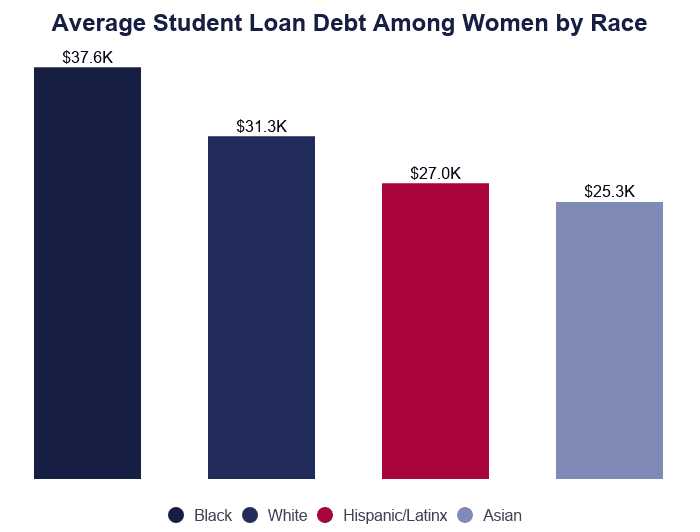

Student loan debt is the perfect storm for women and debt – because women are more likely to get a college education, women carry 58% of the student loan debt in America. Because our college education still leads to lower earning jobs, women tackle student debt while being choked by the gender pay gap. And because we are often the primary caregiver for family members, time off and lost income means it takes us longer to pay off education debt. And all this disproportionately impacts black women.

(Source: American Association of University Women report 2020 https://www.aauw.org/app/uploads/2020/03/DeeperinDebt-nsa.pdf)

Perfect storm. But, your education debt doesn’t have to be a student debt crisis.

Top tips for paying down student debt:

- Make the monthly payments a priority, like a mortgage. That degree benefits you over the life of your career, so make a long term plan and commitment.

- Choose the most aggressive payment plan you can afford, given that priority. Low income women are often pushed toward income-based repayment, which can result in your balance GROWING.

- Consider refinancing your student loan debt – there are a lot of tradeoffs between federal and private student debt. (Many women are hoping for President Biden to end their student loan debt struggle in 2022 – I don’t see it happening). I chose a private loan reconsolidation because it cut my interest rate in half. But there are circumstances where sticking with Stafford or Plus loans make more sense. Post on this to follow!

DEBT AND FINANCIAL ABUSE

I don’t think we can talk about debt without talking about financial abuse, where women are disproportionately impacted. Women who experience domestic violence find their financial security threatened because their abuser has control over the money or thanks to family dynamics and responsibilities and the gender pay gap, they will have a low income as a single mom.

An abusive partner isn’t just one who commits domestic violence, it includes money issues like spending control, hiding finances, gambling addiction, withholding money to pay for things that you or the children need and threats about money. Many women are fearful of the financial cost of leaving an abusive partner and struggling already – whether they can make it as a single parent is a big fear.

DOMESTIC VIOLENCE TRUMPS FINANCIAL ANYTHING

Debt advice: It does not matter if you are saddled with debt when you go. It’s more important that you and your children are safe. Anything you need to do financially to get out, I fully support you. Crater your credit, take out a terrible loan, set cash on fire to create a smoke screen. Whatever it takes.

If you find yourself in this situation, start gathering a go bag emergency fund and call the National Domestic Violence Hotline at 1-800-799-7233 or reach out to a local legal aid office. Often, they can not only help you find financial support and services for you and your children, but also help you navigate protecting yourself from domestic violence.

Single Parents rule. I’m glad my mom left.

WOMEN’S DEBT HELP

As a single woman, you have a lot on your plate, but you don’t need to feel overwhelmed by debt. It is possible to get your finances back on track, and even save for an emergency fund. The most important step is to form a plan, commit in the long term, choose a repayment method you think you can stick to, and later add in supplementary sources of income! You don’t get out of debt overnight.

Join our AskFlossie community where all women are empowered with community and knowledge to build stronger financial lives and overcome debt. We’re here to be your financial wingwoman!