An Emergency Fund is a buffer between you and financial disaster when the shit hits the fan. It’s a financial safety net that helps protect your housing, kids, credit score, health, safety and future, when you get a nasty money surprise.

That 3-6 Months worth of expenses? It’s a made up number. Read on!

Key Takeaways

- Our emergency fund definition: truly unexpected expenses (you need to take unpaid family leave) , not inconvenient or semi-annual ones (car insurance deductible or maintenance)

- Emergency funds are more critical for women, because we are more likely to be responsible for children or dependent elders

- How to save an emergency fund from scratch, where to keep it, and how to protect it

- Learn some cool tricks, like how to use contributions to your Roth as an emergency fund

Unexpected Financial Emergencies Vs Reserve Funds/Sinking Funds

I see a lot of misinformation about what an Emergency Fund is for. Let’s be clear about what unexpected financial burdens are really an actual emergency – and what’s not.

Unexpected Emergencies (experienced by women I know):

- You lose your job to COVID shutdown or economic downturn

- Your partner becomes unstable and you need to grab the kids and go

- One of your kids gets cancer and you need to take unpaid family leave

- Your dog gets hit by a car and needs life saving surgery

- Your roommate decides you’re “not a fit” and kicks you out with one week notice

- Your twins arrive a month earlier and spend six weeks time in the NICU two towns away

- You experience a traumatic event and need therapy and medication to manage the PTSD (This was me – your mental health can absolutely be an emergency.)

- Your husband has a major bike accident and gets airlifted (not covered) to the hospital

- You become the guardian of your sister’s children due to her substance abuse and mental illness

Not Emergencies (also examples from women I know):

- You want to take some time off to see if you want to be a SAHM

- Your partner wants to switch careers and take a lower paying job

- You decide to divorce

- Your cat needs teeth removed (looking at you, Giacomo)

- You have a baby and your cash flow radically changes

- Your mother passes away and you pay funeral expenses and travel to mourn her

- Your father has not saved for retirement and needs assistance

- You have racked up some credit card debt and its a scary amount

The second list are all important, urgent, and worthy things to spend money on. The first list? You would NEVER confuse the first list with anything other than a crisis.

Emergency = Emergency

SO, WHAT IS AN EMERGENCY FUND?

Emergency savings accounts act as buffers that keep you on course in tough financial situations. Moreover, it is a fund that protects your other finances and assets during a crisis. For instance, a good emergency fund means:

- You don’t have to take a loan from your 401k to pay for a medical emergency

- You don’t have to cash out retirement savings to pay monthly expenses you take FMLA

- You don’t have to raid your regular childcare budget to pay bills when you get laid off and need to job search

Ideally, an emergency fund should meet certain requirements:

EMERGENCY FUNDS ARE CASH

Emergencies cannot wait. Consequently, an emergency fund should contain cash or high-liquidity assets you could sell immediately with little downside. For this reason, some people consider the contributions to their Roth accounts as part of their emergency fund – you can pull them out without tax or penalty since you already paid tax on it.

EMERGENCY FUNDS ARE FAST

The emergency fund should be held in an account you can get money out of within a day or two.

EMERGENCY FUNDS START SMALL

Most Americans can’t meet a $400 surprise bill without going into debt – so start there. $400 is how much a friend of mine had to flee a marriage. Years later, as a single mom, she has 6 months worth of expenses saved, which is a great goal, but she focused first on covering her buns.

TYPES OF EMERGENCY FUNDS

As I mentioned before – I think women need at least two savings accounts. These savings accounts serve different purposes and different levels of urgency.

THE GO BAG

If you live in California your “Go Bag” is the bag you grab when there is a major earthquake or fire and you have minutes to evacuate.

The “Go Bag” Emergency Fund is the financial equivalent. It’s the secret cash you have on hand if you have to grab a kid and run.

Any amount you can hide in cash is good, even if it’s a small buffer. A $100 or $200 emergency fund protects you in a crisis. My Go Bag is $1000 because it could hide my family for at least a month. Maybe crazy, but everyone is different. Figure out what that number is for you and begin saving.

Update: a Jamaican finance friend shared this is called “Vex Money” in the Caribbean. Here is an article on Vex Money by a Professor at the University of the West Indies, Anne Crick. I love how she ties this practice to self-care and self-respect.

My favorite example of The Go Bag is from Moira in Schitt’s Creek, whose Go Bag is an actual bag.

THE CORE EMERGENCY FUND

The Core Emergency Fund sits in a savings account and is some amount of emergency savings that makes you feel safe. My list of emergencies mostly don’t require having cash on hand, so an online savings account is a great option for this.

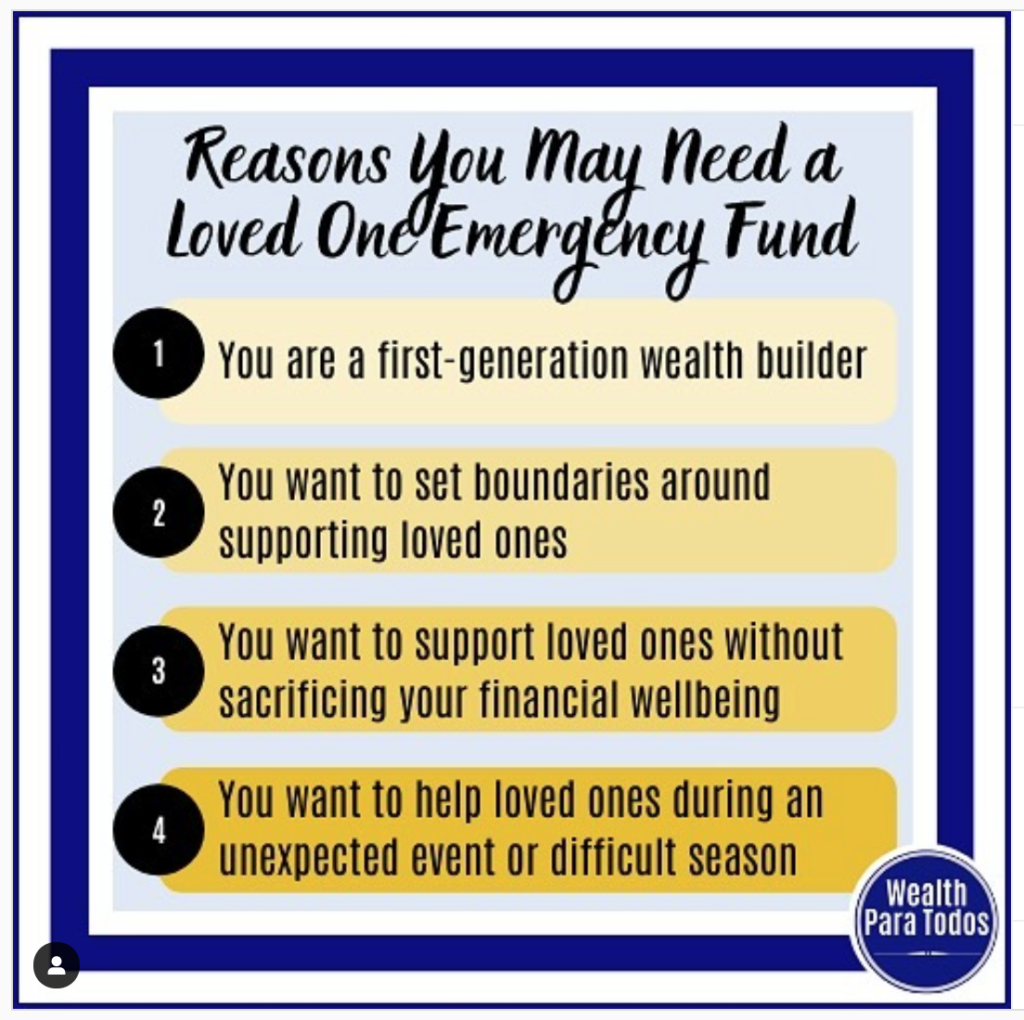

THE LOVED ONE FUND

The Loved One Emergency Fund, a fantastic idea I learned from Rita-Soledad Fernández Paulino, at WEALTH PARA TODOS. Soledad notes that women from collectivist societies can be impacted deeply by other people’s financial instability. She suggests that you may want to build an emergency fund to step up for a loved one if you are a first-gen wealth builder, but also want to set some boundaries on a cash gift for your own financial health. Check out her post on it (below) and fun reel on it!

HOW BIG SHOULD YOUR EMERGENCY FUND BE?

The traditional recommendation 3-6 months of “Necessity” living expenses is kind of a made-up number. Here are some actual guidelines:

PLAN TO BE UNEMPLOYED AT LEAST FOUR MONTHS

In November 2021, It took 45% of unemployed people more than 15 weeks to find a new job. That’s about four months. But 32% took more than six months.

MODIFY THAT NUMBER BASED ON YOUR AGE, INDUSTRY, ROLE, AND LOCATION

A 60-year-old pharmacist assistant at the only pharmacy within an hour of her house is going to have a harder time replacing her income than a mid-level programmer who lives in Silicon Valley.

CONSIDER FAMILY FACTORS

If you are planning on starting a family, a bigger emergency fund is a good idea. I know a lot of people who had surprises with kids under five (Medical, Covid, Special Needs, etc.).

SAVE TWICE YOUR OUT OF POCKET MAX FOR HEALTH INSURANCE

No matter what kind of health insurance plan you have, figuring out the true cost of health insurance is complicated. The most important number is your “out-of-pocket maximum” from your health insurance. This is the amount of money that you could pay per year including your deductible.

Although it’s very unlikely you would hit this number, a medical emergency could max it out almost instantly.

More than 67% of all bankruptcies were medically-related, so being able to pay max medical bills for 2 years offers major financial security.

CONSIDER CHRONIC ILLNESS, MENTAL HEALTH AND DISABILITY

Women are far more likely than men to become disabled, have a chronic illness, or seek treatment for mental health disorders. It’s really easy to blow these off, so let me illustrate with some personal stories.

Therapy is a huge privilege – it’s rarely covered by health insurance, and it’s not cheap. After a three-year battle with stillbirth, miscarriage, and several medical emergencies, not only had I maxed out my deductible, I had was diagnosed with terrifying PTSD. But being able to pay for therapy, so I could keep it together enough to keep my job was CRITICAL to our financial security as a family.

I also have two chronic autoimmune diseases. They are inherited and permanent. I would die without daily medication and would certainly not be able to work. And have gone bonkers and created health emergencies and unexpected expenses.

Disability insurance is worth it and covers some of these issues – but it’s generally limited in terms of the benefit it provides and also has long elimination periods. Your emergency fund should cover what disability insurance won’t.

ACCOUNT FOR YOUR LIKELY RISKS

Different women have different risks. A woman renting in a tight housing market would have a big unexpected expense if her roommate got picky.

HOW TO BUILD EMERGENCY SAVINGS

There are a million ways to build an emergency savings account.

One of my favorite posts by Dasha Kennedy of @thebrokeblackgirl shows how to build a $1000 emergency fund in a year, with monthly amounts of $30-130. She also does a 16-week challenge to get to $500. Making it more of a game for yourself, and setting achievable goals, can keep you focused. (Dasha is a great follow if you’re trying to save your first milestone – she makes it fun).

EMERGENCY FUND HACKS

There are some ways to make the first $1000 a lot less painful. Here are just a few:

BRING A FRIEND

Make saving a team sport. The more you discuss money, plan, and save with your partner, even if it is rocky at first, it is like cement on the foundation of your relationship. And a lot more fun. As rocky as our first money conversations were, I love planning with my husband. And he tolerates me.

JOIN A SAVINGS CHALLENGE ON INSTAGRAM OR REDDIT

You are not the only one trying to slay this dragon. Use social media to be social and join a savings challenge. It can REALLY help you meet your goals.

On Insta, search the #savingschallenge hashtag for “Recent” and find a vibe you like. On Reddit, /r/frugal and /r/personalfinance have savings challenges, plus commentary of course. Buzzfeed also has a list of different types of savings challenges.

SAVINGS APPS

This is a placeholder to remind me to check out Cleo and Chime. I find their products intriguing but haven’t tried them out. Email me if you have!

SAVE YOUR TAX REFUND

Saving my tax refund was MY JAM when I was single and trying to save money. You simply update your W4 to have an additional amount of tax withheld. It’s a little tougher with the new W4 form.

This move is particularly powerful for low-income savers, who also benefit from refundable credits.

GET INSURANCE

So many of the financial crises that cause bankruptcy could be avoided by prioritizing insurance. Insurance is one of (if not THE) safest part of a financial plan.

WHERE SHOULD YOU KEEP YOUR EMERGENCY SAVINGS?

You want to make sure this bank account is safe, accessible, and (if you’re me) that you’re not tempted to spend it. Here are a few options:

ANY SAVINGS Account OR MONEY MARKET ACCOUNT

Worry too much about where to start saving money. Both awesome (0.5%) and average (0.06%) interest rates are crummy. It’s more important to move NOW if you don’t have one. Whatever savings account your bank or credit union offers is fine, as long as it allows you to direct deposit or save automatically.

Furthermore, this savings account isn’t an investment account, it’s a safety net. It does its best work by just sitting there every day, ready when you need it.

ONLINE BANK FOR SAVINGS

Online banks offer two benefits if you want a little boost: first, they have higher interest rates, and second, it’s harder to get at your money

I don’t recommend Barclay’s – their website was dated and clunky. Ally Bank gets great reviews for customer service and has the highest rates I saw when writing in December 2021. I am also a long-time customer of American Express. Their online savings has great (if not top) rates, but Amex wins on customer service. (Neither of these is a paid link – just my take)

PREPAID CARD EMERGENCY FUND

A prepaid card is like a gift card. It’s not connected with a bank or credit union, and you can only spend the amount on your card. It’s really convenient and easy to hide. The downside: high fees and if you lose it, it’s gone.

CASH EMERGENCY FUND

Another option is keeping cash on hand for emergencies, either in your home or with a trusted family member or friend, like the Go Bag. Keep in mind that cash can be stolen, lost, or destroyed, and you need to hide it well.

No matter what financial institution you choose (credit union, online bank, checking account, or cash, make sure you are regularly contributing more money until you feel good about your future security.

What Next?

After you The next step is to invest extra savings in retirement funds to help build your retirement security. We have a great post to help women start with financial and retirement planning.

While you can’t predict unexpected expenses, you can prepare for them. As a single woman, a buffer will improve financial security and can help you sail through financial hardship courageously.