There is so much dangerous fear-mongering about recession right now. I wanted to set the record straight and explain what’s going on and how much you should be worried about it. To be honest, discussions of recession make my eyes glaze over, so I tried to make this fun. With chicken memes.

The real story is how to survive inflation, which is crushing low income households and scaring the s#!% out of single parents.

Key Takeaways

- Answers to “Are we in a recession?” and “Are we headed for recession?

- What factors influence whether or not recession is declared

- How to prepare your finances for recession 2022!

Is a recession coming in 2022?

Short answer: probably.

Economic forecasters are gazing into their crystal balls, weighing economic growth, inflation, unemployment rate, Russia, China, and all our pent up consumer demand for a fun summer. Economic research and business leader have slightly different opinions about recession this or next year. But they all range from a soft landing to doom: “Not at this point. It doesn’t mean it is out of the question” (International Monetary Fund Managing Director Kristalina Georgieva) to simply, “yes” (Jane Fraser, CEO of Citi).

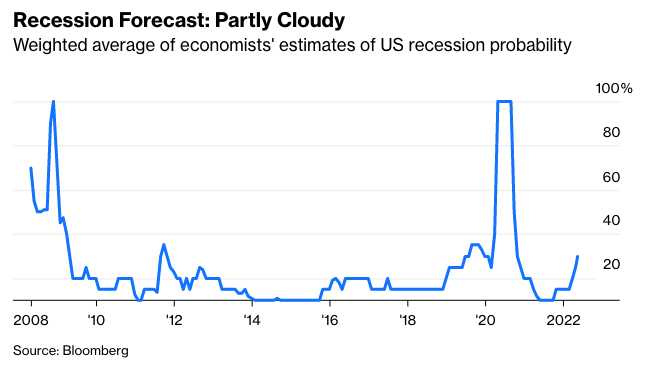

The notable counterpoint is a panel of Economists at Bloomberg, who put the risk of inflation at 30% (up from their baseline of 15%) and target inflation for 2024 at 2.76.

That would be great.

Are we in a recession?

No. (as of June 2022)

A recession is defined as two consecutive quarters of negative economic growth, or as the The National Bureau of Economic Research says “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” They are the ones who actually declare it.

Economic output declined at a rate of 1.4% in the first quarter of 2022, but that’s pretty mild. The Atlanta Federal Reserve has a GDP “Nowcast” that estimates the next official release. They’re currently expecting 0.0%.

Is the economy going to crash?

The obvious follow-on question to “we’re probably going to have a recession,” is “OK, well how bad will it be?” Are we talking gentle economic decline, mild recession, or economic collapse a la the financial crisis of 2008/2020?

The consensus seems to be “not that bad.”

The Recession Banana

David M. Rubenstein, founder of the mega international Private Equity firm The Carlyle Group, told a story about when President Carter’s White House inflation advisor Alfred Kahn was told, “Don’t use the R word. It scares people.” So, he started calling it “banana.” (I am not making this shit up. It was December 1978. I fact checked it.)

Rubenstein said last week, “A banana may not be that far,” but also that he doesn’t think an economic downturn will be that bad. “It’ll be a mild banana, if there’s a banana.”

For real, we let these guys run the U.S. economy.

A Note on the Global Economy

Although I have been mostly focused on shenanigans in America, the global economy matters. A lot.

The U.S. has been the engine of growth for the global economy for a long time. But that’s changing. China is now the world’s largest economy, and their growth rate is about double ours. India is not far behind, with a population that’s almost four times ours.

What does that mean for us?

It means that we are no longer the primary driver of global economic growth. In fact, we are one of the train cars. A recession in Europe or Asia will have an impact on our economy, even if we are not in a recession ourselves. The prospect of a global recession is real.

Global Growth Outlook

The economic slowdown has already started in other countries. According to a June report by the World Bank:

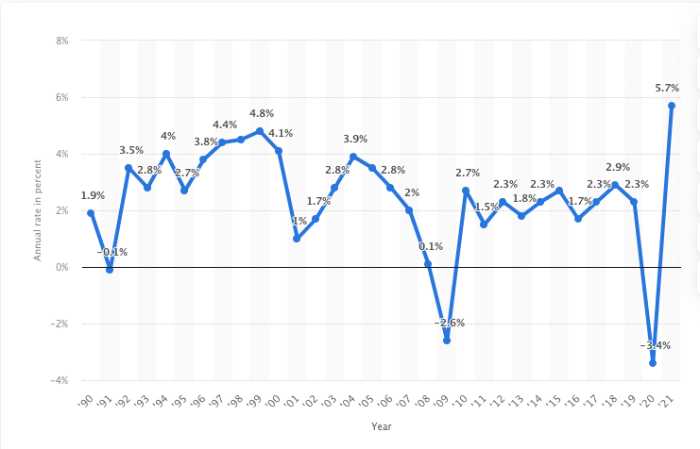

Global growth is expected to slump from 5.7 percent in 2021 to 2.9 percent in 2022— significantly lower than 4.1 percent that was anticipated in January. It is expected to hover around that pace over 2023-24, as the war in Ukraine disrupts activity, investment, and trade in the near term, pent-up demand fades, and fiscal and monetary policy accommodation is withdrawn. As a result of the damage from the pandemic and the war, the level of per capita income in developing economies this year will be nearly 5 percent below its pre-pandemic trend.

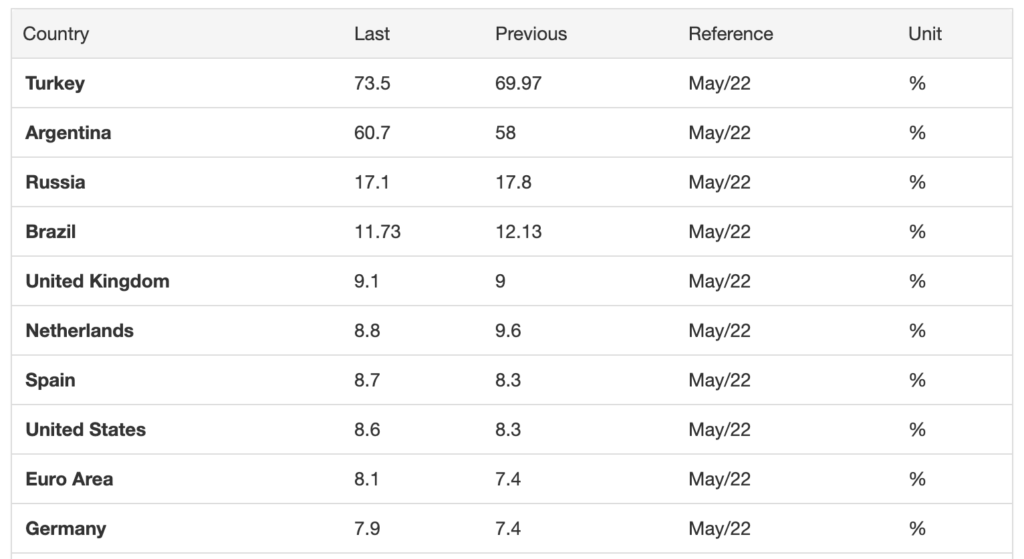

In addition to the slow down in global growth, consumer confidence and real income, high inflation is hitting developing countries harder. We’re worried about surviving inflation in the US, but in Argentina it was 60% last month. Look where the US economy ranks in the “highest inflation Top 10″ among the G20, world’s major economies in the second quarter.

Why are economists not in panic mode?

There are a number of factors at play here. I will touch on them briefly.

Economic Growth

One of the main recession risks is a decrease in economic output. When people are employed and making money, they spend it. That stimulates businesses, who then hire more people, and so on. It’s a virtuous circle.

But when people are worried about their jobs or retirement savings, they cut back on spending. Businesses make less money, so they lay off people. And the circle goes in the other direction.

You can measure this economic activity with the growth of Gross Domestic Product (GDP). The United States Congressional Budget Office projects 3.1% for 2022 in late May. This is high. It also revised up estimates for 2023, and 2024.

We Can Still Raise Interest Rates

The Federal Reserve Bank can raise or lower the Federal funds rate, which is what banks charge each other for overnight loans.

When the interest rate drops, it’s cheaper for businesses to get loans to expand or consumers to get loans for cars and houses. When the rate increases, debt gets more expensive and people and companies rethink their purchase decisions. They don’t buy as much, and prices drop. This is measured through the CPI (the consumer price index). Higher interest rates cool down inflation.

Almost every central bank in the world the world is raising their benchmark interest rate from historic lows, to help inflation chill out.

And to be honest, every federal government projection says they will likely keep increasing interest rates through 2024 to stop cascading inflation. In recent weeks, the Fed announced a rate hike of 0.75% – the largest increase since 1994 – and the stock market barely blinked.

Consumer Spending

Lately, consumers have been on a spending spree. It’s one of the main drivers of the U.S. economy, and with more money in our pockets, American spending is incredibly strong. And consumer sentiment is also very strong. For many, it is still a prosperous period.

As someone who has never been so excited to eat in a restaurant, get my nails done, go on vacation…I don’t see this going down again unless Covid makes a major comeback, Putin goes nuclear, family incomes take a big hit or the economy contracts.

Labor Market and Unemployment

Slightly higher interest rates lead to slightly higher unemployment. Why? When it is more expensive to borrow, businesses to put off expansion plans and pull back on production. They don’t hire as many people, they stop hiring and or they do payoffs.

But we’ve seeing the opposite job market for the last year – labor shortages. The jobless rate is at the lowest level we’ve seen in a while. It’s so good even teen employment is at a 20-year-high. Tight labor markets with high job growth like this one are a great thing. So, the Federal reserve is comfortable with some job losses.

The Congressional Budget Office projects the unemployment rate will be slightly higher in 2023 and 2024 than it is now, but not a lot.

Supply Chain

Supply chain issues have a big impact on the economy because they can make it very expensive to sell a good. So when there are supply chain problems, like there have been many in the last year, companies find solutions and economists ask if these are permanent issues.

The thinking seems to be that most current issues with global supply chains will resolve. For instance, we figured out the backlog in the ports. At some point, factories in Asia will be back up at full capacity. Oil prices and gas prices will go back down. And companies and supply chains will adapt. Example: once again, we can buy toilet paper.

Inflation

When inflation spikes, Central banks of the past hit the brakes. Hard. For instance, in 1979 the Fed cranked the overnight lending rate to 20% in an attempt to curb inflation. This rapid increase of the inflation rate and extremely expensive debt can cause growth to slow down quickly, leading to a major recession. Some have argued that a similar dynamic caused the Great Depression.

This is why the Federal Reserve is suuuuuuuper cautious about raising rates or even hinting they will raise rates. While they are aware of that high prices are a big inflation problem, they don’t want a hard landing or anyone to overreact. So, they announce several expected rate increases in the coming year and tell us repeatedly, so no one freaks out when it happens. They have been doing this for the past year at least.

Stagflation and Doom

On the flip side, former Fed Chairman Ben Bernanke thinks we’re cruising for stagflation, which is like when a plane is going up (inflation continues to rise) then mysteriously stalls and plummets to earth (economic growth collapses, unemployment soars). Those two things are not supposed to happen together, but they have in the past.

Fortunately, Bernanke is the outlier in this view, and has what some would consider a maverick approach – he increased the Fed’s balance sheet dramatically during the Great Recession.

Are Economists Good At Predicting Recession?

Stagnation, and other mysterious anomalies of the chicken world, highlight an important point: economists are not great predictors of the macroeconomy, and it might not even matter. If you look at the graph above, in 2020, Bloomberg economists were 100% predicting a recession for two quarters. Then the prediction dropped to 30% in the next quarter.

Predictions don’t mean anything compared to the actions that governments (e.g. stimulus payments and other monetary policy), populations (e.g. shifting spending and savings behavior) and companies (e.g. work from home) take in response to economic conditions.

We are not an inert thing recession happens to. It’s always a dance.

How to prepare for recession 2022

It’s always good to be proactive in advance of a potential recession. Here are some tips on how to prepare.

Pay down or off variable interest rate debt

If you have debt with a variable interest rate, now is the time to pay it down or off. More rate hikes are coming! Every Central Bank in the developed world has signaled a plan for future rate increases, so all variable consumer debt will see rising interest rates in the next two years. That means rising mortgage rates, and credit card bills.

Save enough to ride out a job change

Unemployment and slowed hiring are hallmarks of a recession, so it’s important to be financially prepared for the possibility of losing your job. One way to do that is to save four months’ of necessary expenses as part of your emergency fund so you can ride out a job loss without going into debt.

Build your emergency fund

With Emergency Funds, I usually recommend starting small, because its more achievable, but the average job search tends to take 3-4 months, and in a recession, could take longer. Things may also get more expensive in the near term, which will make a stretch with no real income more difficult. There’s no downside in having multiple bank accounts for your goals.

Modify your budget now, to reach for the higher safety goals.

Diversify your income

Right now, we have a strong labor market, which means it’s (still) relatively easy to get a job. If you are employed, now is the time to start looking for additional sources of income. This could be a side hustle, or it could be a plan for starting your own business. The goal is to have multiple streams of income so that if one dries up, and the labor market isn’t your friend, you are not left high and dry.

Additionally, additional income can help with savings goals.

Don’t go crazy in the stock market

The financial markets are going crazy all on their own! They don’t need help. Honestly, unless you are straight up gambling with options or margin calls, the average person is best served by setting up some automatic investing and losing their credentials. Time is still the best investment tool.

In the long term, the market will recover.

In the short term, it’s going to look like fireworks in the chicken coop.

Spend Carefully

I… am not a natural saver. And I do not believe you have to be born frugal to either get good with money or get wealthy. But in a recession, you need to keep a closer eye on your spending.

Personally, I wouldn’t spend a lot of money on buying a home or renovations until things cool off. Home prices have really been hit with surging inflation, thanks in part to the supply chain issues and the Work From Home Migration. The housing market has gotten too hot for me! Similarly, commodity prices (like wood, which is what most houses are made of) are really high. I don’t see house prices plummeting.

Final Thoughts on the 2022 Recession

While economists may not be able to predict a recession with 100% accuracy, there are still some things we can do to prepare for one. I reject the idea that inflation is a thing that happens to powerless actors. Wind happens. Rain happens. Humans are still smart enough to put on a jacket. (Chickens not so much!)

Paying down with variable interest rates, building up your emergency fund, and diversifying your income are all good ways to weather a potential recession. And while the stock market may look volatile in the short term, it will eventually recover. Just be careful with your spending and you should be able to weather any storm.