“What tax filing status should I use?” was probably the #2 most frequent question I answered this year. It’s actually a tougher call for women!

(Number One: Will I still get a refund from the Child Tax Credit?)

Which one is best for you depends on your particular situation, so we’ll take a look at each of the most common statuses-single, head of household, married filing jointly, married filing separately, and qualifying widow-and explain when to use each. We’ll also discuss how to choose when you have two options.

The good news is you’re not alone here – every year tens of millions of women file their own taxes – successfully!

Key Takeaways

- Filing as a single woman means you’re unmarried and have no children or other dependents

- Head of Household is the IRS’s way of counting a single moms as a person and a half. It’s awesome.

- “Married filing separately” status rarely applies – this is for separations still in process or specific debt situations.

Filing Status Definition

What is a filing status? When you file your own taxes, you choose one of the following five tax filing statuses: single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

The filing status you choose affects which tax deductions and credits you are eligible to take. Your tax filing status depends on two things:

- Your marital status

- Whether or not you have dependents

Since women are more likely to be custodial single parents or support an aging parent, a lot more of us are “Single,” “Head of Household” and “Married, Filing Separately” . (Also, Married Filing Jointly, but that one is obvious, so I’m not going to cover it).

Whatever tax software you use usually makes your filing status easy. Still, it might not judge your particular situation perfectly, so at the bottom of this post is a screenshot of the IRS Form 4012 (aka the Holy Grail for 75% of tax questions) to help you confirm. Let’s dive in.

The IRS Definition of Married

The IRS considers you married for tax purposes if you are married according to the State law where you currently live, no matter where you lived when you got married.

If you and your spouse live in a community property state, then you are considered married if the community property laws apply.

Generally, the IRS uses your marital status as of December 31 for the whole year, unless you are separating and declaring dependents.

Tax Filing Status Single

Filing as a single woman means you’re unmarried and have no children or other dependents. In this scenario, you might be:

- Never married

- Legally divorced

My toddler’s favorite baby sign language is for “All Done” – that is what your divorce needs to be **as far as your state is concerned** to file separately. (Otherwise, you

Fun fact, from a tax perspective you are “Single” even if you are still cohabitating with an Ex. The IRS cares about your legal status, and considers a cohabitating Ex about like a roommate. Except waaaaaay less fun.

For 2021, the standard deduction for filing as a single person under 65 is $12,550 and for 2022, it is $12,950. Unless you are a homeowner or have major medical expenses, the standard deduction is probably fine, but definitely double check as you prepare your taxes.

Head of Household Filing Status – The Single Mom’s Club

FUN FACT: Over 80% of Head of Household Filers are women.

When you file as Head of Household, it means you’re not married, but have dependents – whether they’re your kids or other relatives. I love this filing status. Pro Tip: Learn more about the 2021 Child Tax Credit for Filers with Kids.

Head of Household is the IRS’s way of counting a single moms as a person and a half.

Single or custodial parents are likely raising a family on a single income, very possibly without financial help. To acknowledge how hard that is financially, they increase the standard deduction by ~50%. So you get taxed on ~$6000 less of your income.

Qualifying Dependents for Head of Household

One great thing about this filing status is you don’t necessarily have to be a mother. Your dependents are maybe a qualifying relative, or even a qualifying parent. This might apply to you if:

- You’re single as of December 31 of the previous year

- You pay more than half the household expenses

- Your dependent lives with you for more than half the year

- Your aging parent does not live with you, but you provide more than half their support

IMPORTANT: If you’re still in the divorce process and don’t want to file jointly with your spouse, you are still considered Head of Household if you lived apart for six months of the year and agree to file separately.

Another convenient aspect of Head of Household is if you have children over 18, you can still claim them as a dependent if they’re a full-time student or disabled.

More for Single Moms: How to Document Child Care Costs so you can get the most out of child support and the Child Care Tax Credit. And Four Things Women should know about Divorce Taxes in a post-Trump world.

Married Filing Separate Tax Status – “It’s Complicated”

I would like to buy a margarita for anyone filling as “Married Filing Separately” or MFS, because one of two things is happening:

- You are paying off a lot of debt

- You are in mid-divorce

Girl, in either case, you deserve a marg.

The IRS knows intimately how complicated peoples lives can get – “separated but still working out your divorce settlement” is a status you can live in for years. “Separated, but we still keep our finances together for legal reasons” is another legit reason to use this filing status.

Here is the one thing to remember: the other party has to agree to the status.

Technically, you don’t have to have agreement, but if, for instance, you file MFS and they submit using any other tax filing status, their return will be rejected. And vice versa. So coordinate early to avoid headaches. I’m really, really sorry you still have the overhead of this relationship in your life.

Married Filing Jointly Vs. Separately

There is one important difference between filing as Married Filing Jointly and filing Separately. If you file separately, you are not held responsible for your spouses tax return. This is important because, if your soon-to-be ex owes Uncle Sam a significant amount of money, you are not on the hook for it.

When Does Married Filing Separately Make Sense?

Here are two scenarios where I have seen people who are happily married with intermingled finances use the separate tax filing status:

- Income-based debt repayment (usually a student loan). Filing separately gives you a tax return with *only* your income on it. If your spouse earns a lot more, you can file separately and qualify for better income-sensitive repayment plans using just your info.

- Separation. It can take years for some divorces to finalize, and the the status for people in limbo. Also, some people chose to stay separated rather than divorce for a wide range of reasons, from financial complications (you will know if this is you, generally its a pension or rare benefits) to religion. Married filing separately is how you tell the IRS that yes, you’re still married by their definition, but your finances are separate.

These are both neat tricks, but as ever proceed with caution – don’t get creative with your deductions. Pro tip.

There may be limitations on your ability to file separately if you live in a community property state.

Married Filing Jointly Tax Status

Most married people will file their taxes jointly. If you file a joint tax return, both you and your spouse are responsible for any taxes or penalties owed. This allows you to use only one tax return. Married filing jointly is a tax filing status that is available to any married couple who got married as of December 31 of the tax year.

When one spouse earns more money than the other, it is often a good idea.

If you file your taxes jointly with your spouse, your total tax liability will often be lower than if you filed separately. The IRS offers couples various tax benefits that don’t apply to the other filing statuses, to encourages them to file together.

Couples who file their taxes together can qualify for multiple tax credits. These include the Earned Income Credit (EIC), the child and dependent care credit, the American opportunity tax credit (AOTC), the lifetime learning credit (LLC), and the saver’s tax credit.

You may also need to file as Married Filing Jointly if you contribute to a traditional IRA and your spouse is covered by a retirement plan at work (unless they give you a release).

Qualified Widow Filing Status – Proof The IRS Has A Heart

Qualified widow is a tax filing status for people who lost their spouse in prior years. The year of your spouse’s death, your filing status is married filing jointly. The next two years, you get to file as the more advantageous Qualified Widow. The benefit of filing as a Qualified Widow is a higher standard deduction and a lower tax rate.

Essentially, the IRS says “The last couple years have been really sh**ty. You get to file as if your spouse was still alive and we’ll give you a break on your taxes.”

You can file under Qualified Widow for up to two years after the year of your spouse’s death. To qualify for this filing status, you must not have remarried before filing.

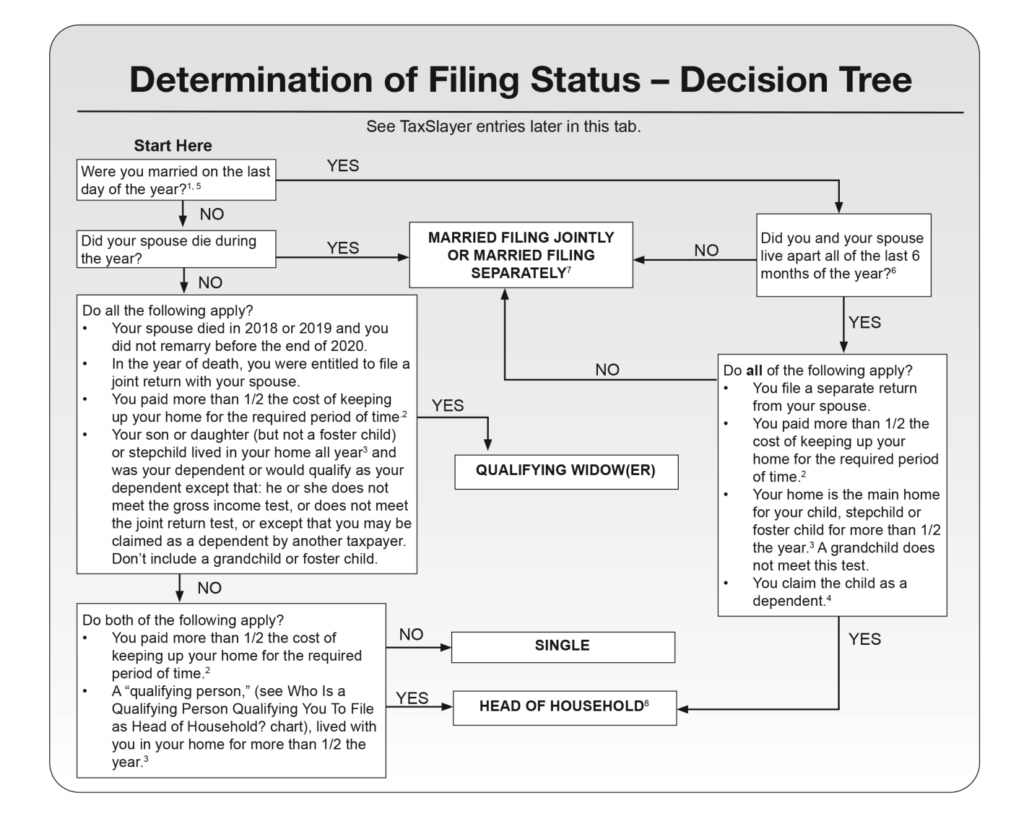

Tax Filing Status Decision Tree – IRS Form 4012

I love the Form 4012. Even more than the TurboTax boards.

This form is actually a book that VITA volunteers use to navigate big tax questions, like filing status. It has a handy flowchart to walk you through the filing status options.

Join our AskFlossie community where all women are empowered with community and knowledge to build stronger financial lives. We’re here to be your financial wingwoman!