Updated for the 2022 Tax Year in February 2023! Let’s get those tax breaks!

Tax season is upon us (wooo! I’ll stop…) and that means it’s time for The Great Accounting. Many tax breaks for single moms and single women are available to help save you money. And they can be worth over $10,000 when added up.

In this blog post, we will discuss some of the best tax credits, and those most used by single moms.

Key Takeaways

- +70% of Head of Household filers are women – this filing status is one of the biggest tax benefits for single moms

- You can receive tax credits for your kids, elderly parents, and childcare payments directly related to being a custodial parent

- Other credits like higher education costs, student loan interest and the AOTC disproportionately help single moms – make the most of them!

Do single moms get tax breaks?

You bet they do! In fact, single moms can get a few different types of tax breaks, both in the form of tax credits and other tax advantages that it often makes gentlemen with high tax bills cry, “Unfair!”

We will offer them a tiny kleenex for their tears. And remind them that single moms make about 47% (median) of what a married couple makes.

Single moms should take all the tax breaks they can get.

How do single moms get so much back in taxes?

It starts with the amazing head of household status, which lowers the income threshold for tax credits and increases the standard deduction.

This is intentional design of our federal income tax system – not accidental. The IRS is trying to lower every single parent’s tax liability to increase single parents’ financial security.

I like to joke that Head of Household is the government’s way of acknowledging that single parents are a person and a half.

Single moms should use the Head of Household filing status!

But, did you know over 80% of custodial single parents are moms? Which means that the overwhelming majority (+70%) of tax filers who claim the HoH status are women. (The discrepancy comes from exes trading who gets to use the kids as a tax deduction).

The Head of Household filing status is a great way for single moms to reduce their taxable income and save money on their taxes, and is available to single women who support a qualifying child or other relative.

To qualify as a head of household, you must meet the following requirements:

- You must have paid more than half the costs of keeping up a home for the year

- The eligible dependent must live with you more than half the year

If you meet these requirements, you can file as Head of Household and enjoy a number of tax benefits, including a lower tax rate and a higher standard deduction.

Single Moms Should Claim the Child Tax Credit

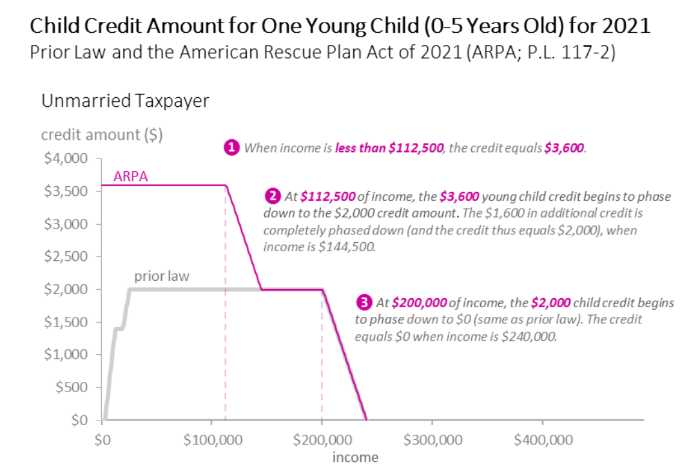

The Child Tax Credit is worth up to $2000 per child under the age of 17 for 2022. The credit is a partially refundable credit, which means it adds to your tax refund if you’re already in refund territory. If not, it lowers your tax bill and gets you closer to a refund. The most you can get refunded for each child is $1,500.

Important note: for most recipients, the eligible CTC will go down in 2022, relative to last year.

Under the American Rescue Plan (ARPA) in 2021, the the maximum credit was higher that it was under the prior law and more than the $2000for 2022. We are back to the “prior law” gray line in this graphic:

Source: https://crsreports.congress.gov/product/pdf/IN/IN11613

How the Child Tax Credit is Calculated

Honestly, the best way to calculate the child tax credit is to just let your tax software do it. But here’s how to check its right.

The credit is based on how much earned income you have and you calculated it by filling out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”). Just take it step by step.

From the starting income of $2500, you get to apply more of the credit as your income grows. The credit phases out for taxpayers who exceed those thresholds, up to the income limit. The income thresholds for single taxpayers and Heads of Households is $200,000.

What this means for single moms: almost everyone qualifies for the full credit.

$500 Credit for Other Dependents

Dependents, like elderly parents, who can’t be claimed for the Child Tax Credit may still qualify you for the Credit for Other Dependents. This is a non-refundable tax credit of up to $500 per qualifying person. The dependent must be a U.S. citizen, U.S. national, or U.S. resident alien.

How To Qualify For the Child Tax Credit

To qualify for the Child Tax Credit, you must have a dependent child who meets the following requirements:

- The eligible child must be under the age of 17 at the end of the 2022

- The child must be a dependent (meaning your ex isn’t listing them as a dependent on their taxes)

- The child must have lived with you for more than half the year

- You need earned income of at least $2,500 in a given tax year

If you meet these requirements, you can claim the Child Tax Credit on your taxes. This credit can save a single mom a significant amount of money on your taxes, so 1) advocate for its protection and extension with your elected officials and 2) watch out for that 17th birthday that makes the child tax credit go poof!

Working on your 2021 Tax Year? Read everything about the 2021 Child Tax Credit in our standalone article. Everything was different in the pandemic, thanks to the American Rescue Plan Act (ARPA).

Claim the Child and Dependent Care Tax Credit

If you are a single mom and you pay for child care so that you can work, you may be eligible for the Dependent Care Credit. This credit can reimburse you for up to $3000 of child care expenses per year, and it is available to single moms who are employed or looking for employment.

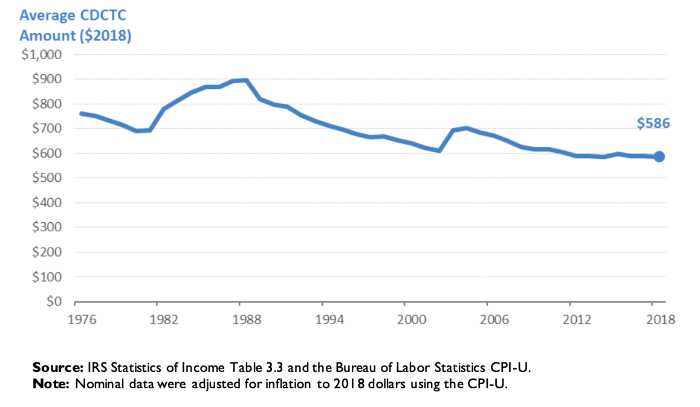

It’s called the “child and dependent” care credit because it applies to both your own kids and anyone you claim as a dependent, including dependent parents. The average credit has been about $600 historically.

How the Dependent Care Credit is calculated

If you had one qualifying person, you can claim up to $3,000 for employment-related expenses in 2022. If you had two or more qualifying children, then you can claim up to $6,000. In 2022, the maximum credit is 35% of your employment-related expenses, and it drops to 20% of expenses if your adjusted gross income is over $43,000.

Like everything related to tax credits, rules under the pandemic were different.

No lie: child and dependent care is a pretty stingy credit. Child care is the number one issue facing working moms, and it’s extremely expensive. If we want to encourage women in the workforce, we need to make the load a lot easier on them with tax benefits.

How to Qualify for the Dependent Care Credit

To qualify for the Dependent Care Credit, you must have a dependent who meets the following requirements:

- a qualifying child under age 13 when the care was provided

- a spouse physically or mentally incapable of self-care

- someone who was physically or mentally incapable of self-care, and either was your dependent or could have been your dependent except for gross income or filing status limitations.

The dependent care credit can radically impact your reported child support costs – so, important topic.

Single Women Should Claim the American Opportunity Tax Credit

Anyone paying higher education expenses can claim the American Opportunity Tax Credit (AOTC) – whether you were the college student or it was your kid.

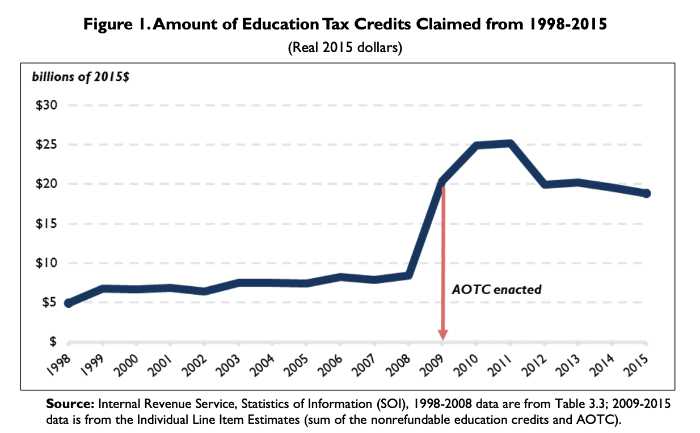

This one is also per kid – a maximum annual credit of $2,500 per eligible student, up to $1,000 is refundable.

The calculation on this one is weird: 100% of the first $2,000 of qualified expenses and 25% of the next $2,000 of expenses. Per student. So anywhere from $0-$4000 in expenses PER KID qualify.

To claim the full credit, a head of household modified adjusted gross income (MAGI) must be under $80,000. Over that, and it’s phased out until $90,000, when it disappears completely.

The AOTC is huge – it nearly quadrupled the education tax relief received by taxpayers when it went into effect in 2009.

Source: https://crsreports.congress.gov/product/pdf/R/R42561/19

How the American Opportunity Tax Credit is calculated

I hate calculating the AOTC, so again, this is one to let your tax software do. But you can check it by going line through line on Form 8863. Its a lot of words, but I swear its only third grade math.

How To Qualify for the American Opportunity Tax Credit

To qualify for the American Opportunity Tax Credit, the student must:

- pays qualified education expenses for higher education (tuition, for instance)

- be enrolled at an eligible educational institution.

- pursue a degree or other recognized credential

- have been enrolled at least half time for at least one academic period (like a semester)

- Not in grad school or year five of college

- Not have claimed the AOTC or Hope credit for more than four tax years

- Not have a felony drug conviction at the end of the tax year

Advance Premium Credit

If you are a single woman and you purchase health insurance through the Marketplace, you may be eligible for the Advance Premium Tax Credit. When the tax credit is included, your health insurance might be cheaper through the marketplace, than through your other options.

How the Advance Premium Tax Credit works

When you sign up for health insurance through your state’s Marketplace, you estimate how much money you will make this year. If you qualify for a premium tax credit, you can use any amount of the credit to lower your premium.

If you take more premium tax credit in advance than you are due, based on your final income, you will have to pay back the excess when you file your federal tax return. If you’ve taken less credit than you qualify for, you’ll get the difference back when you file your tax return.

Even the IRS doesn’t make this easy to estimate in advance, so use Healthcare.gov calculator to see if you’re eligible.

For 2021 and 2022, the American Rescue Plan Act of 2021 (ARPA) temporarily expanded eligibility for the premium tax credit, so this is one of the few ARPA expansions that still apply.

The Earned Income Tax Credit

Congressional Republicans HATE the EITC, but it’s an incredibly powerful credit for single moms and we love it.

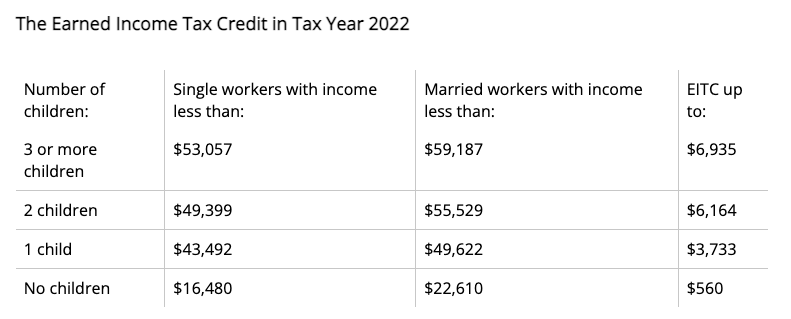

For 2022, the Earned Income Tax Credit is a tax credit worth up to $6,935. That amount increased with your earned income until it hits the max, then gradually phases out. The vast majority of people who receive it are single people, with kids, who are already getting a tax refund. However, many single women are eligible regardless even if they don’t have children. The EITC is refundable, which means that if you owe no taxes, it will increase you tax refund.

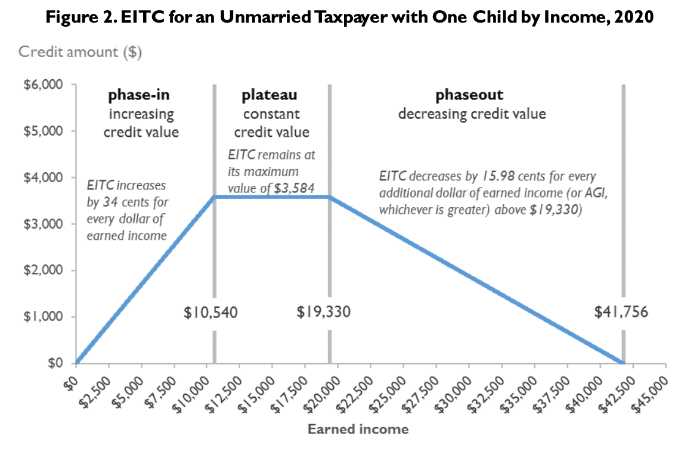

How the Earned Income Tax Credit is Calculated

The EITC depends on your earned income and is specifically designed to increase the tax refunds of households with low income. Calculating the EITC is something you should only do with Tax Software when you are filing taxes, but here’s how it works at a high level.

The EITC depends on several things, like how many kids you have and you marital status, and it phases in and then back out as you earn more money. Here is what it looks like for a single mom with one kid (this is 2020, but works similarly for 2022):

(Source: The Congressional Research Service, https://sgp.fas.org/crs/misc/R43805.pdf)

How To Qualify for the Earned Income Tax Credit

To qualify for the EITC, you need to meet the following requirements:

- Have worked and earned income

- Your income had to be under $57,414 for the 2021 tax year

- Investment income below $10,000 in the tax year 2021

- Be a U.S. citizen or a resident alien all year and have a valid social security number by the time you file

- No foreign earned income

There are also special rules for tax filers with family members with disabilities, clergy, and members of the military. Check the EITC Qualification Assistant to see where you land.

Student Loan Interest Deduction

The Student Loan Interest Deduction (SLID) is one of the best single mom tax breaks and can save you up to $2500 on your taxes. The deduction is available for both federal and private student loans, and it can be taken even if you don’t itemize your deductions.

Head of Household filers with less than $90,000 in modified adjusted gross income can receive some of the deduction, and under $75,000 in MAGI can receive the full deduction.

For purposes of SLID, student loan interest includes both required and voluntarily pre-paid interest payments.

To qualify, a student loan must have been taken out to pay for things like tuition, room and board, books, supplies, and equipment. It can also be used to pay for other important school-related costs (like transportation). In order to be able to claim this deduction, the student must have been enrolled in a degree program at least half-time when the loan was given. The student must also have paid interest on the loan during the tax year.

SLID is different from a tax credit in that it is taken as an adjustment to income – or as tax nerds say “above-the-line” – and thereby lowers your AGI. This helps you qualify for other credits with income caps.

The deduction is phased out for single taxpayers with adjusted gross incomes between $75,000 and $90,000. That’s up $10k from 2021, so moms could see less of this deduction this year.

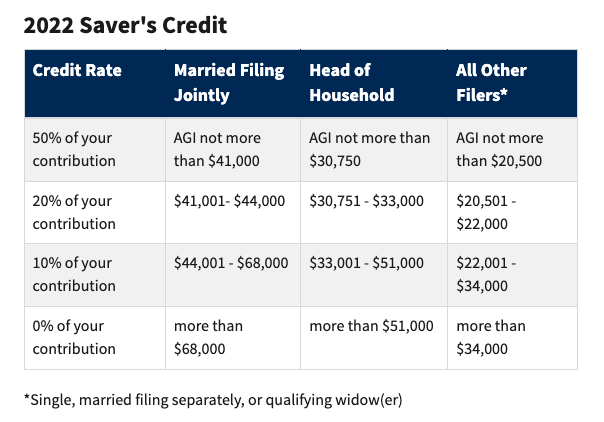

Retirement Savings Contribution Credit

Low income single moms and single women can also get a Retirement Savings Contribution Credit of up to $1,000 for contributions to a 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan. This credit is available regardless of your filing status.

Take advantage of Free Tax Return Preparation

I have advised over a hundred free tax clients through the IRS VITA program, and let me tell you, there is NOTHING I love more than getting a tax refund for a single mom. Single moms will GRILL me on tax credits. And after that, single women are my best clients. They have their shit together!

The IRS Volunteer Income Tax Assistance – Free Tax Prep

The IRS’s Volunteer Income Tax Assistance (VITA) program offers free tax prep, by certified, tested tax nerds like me.There is a tax nerd in your area ready and willing to help, whether you are employed, unemployed, self-employed, or gigging it up with your Instacart side hustle. We love to hunt down tax credits for people.

The VITA program has been helping people for over 50 years. The VITA sites offer free tax help to about half the people in the US, including:

- People who generally make $58,000 or less (*THIS IS NOT FIRM AT ALL)

- Persons with disabilities; and

- Limited English-speaking taxpayers

I encourage anyone making roughly $80k or less to find the nearest VITA Site. You don’t know your Adjusted Gross Income when you walk through the door, and neither do we till we do your tax return, so the income limits are sort of a joke.

Use the Locator VITA tool and call the locations nearest you.

FreeFile Your Taxes With An IRS Partner

The VITA program uses TaxSlayer (affiliate link, 25% off upgrades), and H&R Block (affiliate, 20% off) and TurboTax (affiliate link, $20 off upgrades) both have free options for simple returns. If you’re a homeowner, or self-employed, you can upgrade with any of the big three and your situation will be covered. These three companies process the vast majority of American taxes. Personally, I prefer TurboTax (affiliate) because it’s the easiest to use.

Or you can check out FreeFile to find a software that supports your situation. These have all been vetted by the Internal Revenue Service and offer solid free tax preparation, but are not the prettiest.

Do Not Use The “Free Fillable Forms” Option for the Love of Pete!

I love the IRS, but ALL tax professionals use software to prepare taxes. All of them. No one fills out forms by hand except old curmudgeons with extremely simple taxes. Why? Tax Software is accurate and makes calculations easy.

Figuring the maximum child tax credit or especially the earned income credit manually is extremely error-prone.

Wrapping it all up – Tax Breaks for Single Moms FTW!

If you’re a single woman or mom, make sure to take advantage of these tax credits. You could be looking at a nice refund check – or a smaller tax bill. Either way, it’s worth your time to do some digging and see which of these credits apply to you. And don’t forget to sign up for our community so you can get even more tips on how to save money and live well on a budget!