Years ago, my husband told me had a tax-free HSA retirement account, and that it was better for tax savings than a 401k. I remember thinking he was nuts, and I literally scoffed at him. But he was dead right.

After age 65, you can take funds out of an HSA for anything. Not just for medical expenses. And until then, you can invest it. It’s basically a tax free retirement account.

Lest you think I’m crazy: Maxing out the HSA is our number one savings priority as a family.

The quick overview on why.

- Contributions go into your HSA tax-free.

- They are invested and grow without taxes on dividends or trades.

- After age 65, you can withdraw those funds for any purpose. Medical expenses have 0 tax on withdrawals, while any other withdrawal is taxed like an IRA or 401k withdrawal.

There is no other retirement account that is tax-free at contribution, as it grows and at withdrawal. Here is the Big Cheese of Financial Planning, Michael Kitces on the subject in the Wall Street Journal: HSAs are “the most tax-preferred account available.”

The HSA retirement account strategy is also particularly powerful for women, who live longer, so need their retirement savings to work harder. Women are more likely to be custodial head of households, which qualifies them for higher contribution limits.

Let’s dig into the details!

Key Takeaways

- If you have sufficient income, an HSA is a tax-efficient way to cover your medical costs, while saving for retirement

- Compounded growth from invested HSA savings generates future cash to pay these retirement bills

- Those savings and earnings are triple tax advantaged: they are invested pre-tax, grow tax free, and in the case of medical expenses, can be withdrawn tax free

- You can withdraw earnings tax free to reimburse yourself for lifetime medical expenses – keep the receipts.

Tell Me How HSAs Work

Happy to! An HSA was originally designed to give you a tax break on money set aside for medical expenses. Most people set it up through their employer during open enrollment. To qualify, you also need to carry a high deductible health plan.

If you are self-employed or insurance through your work is not available or affordable, you can still get an HSA. If you buy your health insurance directly, you can set up an HSA directly through Fidelity or Optum. You would then take a tax deduction for the contribution. You still need a high deductible health plan to qualify.

The HSA was designed to pay for out-of-pocket healthcare-related costs like deductibles, copays, or prescriptions with tax-free withdrawals. You can carry the funds forward year-over-year until medical expenses arise.

More importantly, you can invest it, wait till you’re 65, then use it for anything you want.

HSA Vs FSA? Do I Have to Use It This Year?

No! This is always the first question I get. An FSA (Flexible Spending Account) is a use-it-or-lose it account that lets you pay for medical costs with pre-tax dollars. Blessedly, tampons are now included. You get an FSA if you have a PPO or HMO insurance, and if you don’t use all the funds in the same year, they disappear.

An FSA is totally different from an HSA. With the HSA, the money is yours permanently, and you can grow it as long as you want.

How Does HSA Tax Saving Work?

- Contributions to your HSA are tax-free. You contribute to them from pre-tax income like a 401k or take a deduction when you file taxes, like an IRA.

- The contributions are invested and grow without incurring taxes on dividends or trades. This is just like a 401k or IRA. If you purchase shares in a low-cost index fund that pays a dividend, you don’t pay tax on the dividends. OR, if you want to sell part of a mutual fund to diversify into a target age fund, for example, you wont pay any tax on the gain recognized in that trade. This gives you a lot of flexibility to manage how much risk you’re exposed to in the long haul. If you’re younger, you might chose more aggressive funds. If you’re closer to retirement, you might be more conservative.

- After age 65, you can withdraw those funds for any purpose, not just for medical expenses. This is the Lynchpin that no one knows about. HSAs are not just for medical expenses. After you turn 65, you can use withdrawals for anything. Mai tais. Fancy caftans. An armada of pool toys for your grandkids. Oh yeah, and medical expenses, 100% tax free. The Mai Tais and Caftans will require you to pay income tax on the withdrawal, much like your 401k.

How Do You Invest in an HSA Retirement Account?

According to the EBRI, only 6% of HSAs are in investment accounts. So any investing you do here puts you ahead of the game.

“Your investment strategy should be similar to the one you’re using for your other retirement assets, such as a 401(k) plan or an IRA,” according to Investopedia’s great article on HSA investing. And I agree with that. If you’re treating it like a retirement account… treat it like a retirement account.

Many Employers use Optum Bank to manage their HSA, and I like it, except for the monthly maintenance fee. Their fund lineup has a number of low-cost Vanguard index funds. I plan move my HSA to Fidelity, which also (always) has as a good lineup of cheap funds and no fees.

2021 HSA Contribution Limits

HSA retirement account contributions are based on who is covered by your health insurance (self or family) and your tax filing status. It’s kinda messy, so I am going to break it down with real examples. If you stop using an HDHP, you keep your HSA, but can no longer contribute to it.

- Single Lady? Up to $3600 per year

- Married, Same Insurance, Ride or Die Together on your Tax Return: Up to $7,200 per year (only one spouse can contribute)

- Single Mom, Kid on your insurance: Up to $7,200 per year (learn more about the Head of Household status)

- Family, parents and kids on the same insurance: Up to $7,200 per year (only one spouse can contribute)

- Married, Filing Separately: Up to $3,600, each, per year (both can contribute)

- 55 or older? You can make an additional catch-up contribution of $1,000

You might have noticed: the tax-free contribution limit for an HSA is HIGHER than an IRA.

To have an HSA retirement account, you must have a qualifying high-deductible health plan with a deductible over $1,400. The family deductible must be at least $2,800.

Why Is An HSA Retirement Account Great For Women?

You Can Save Even On a Break From Formal Employment

Women often take career breaks to focus on other important goals such as motherhood or further studies. While most retirement plans require formal employment to save, an HSA account does not. You can still make contributions to this account, even when you are not working.

HSA Tax Savings Help Offset The Income Gap

According to GOBankingRates study, women contribute only half as much as their male counterparts to their retirement. Additionally, the median earnings of women as of 2018 was only 81% of men’s. This gap results in less contribution towards retirement and even social security funds. The tax savings in using an HSA as your retirement account, gives your savings the boost it needs.

Turn Your Maternity Bills into Margaritas

It’s not a terrible idea to use an HSA for medical expenses, but defer reimbursement as long as you can. The fact that you can roll your HSA over means you choose when you get reimbursed for those payments – let it sit in a mutual fund and grow in the meantime. The hospital is going to make you pay today, but you can reimburse yourself at any time.

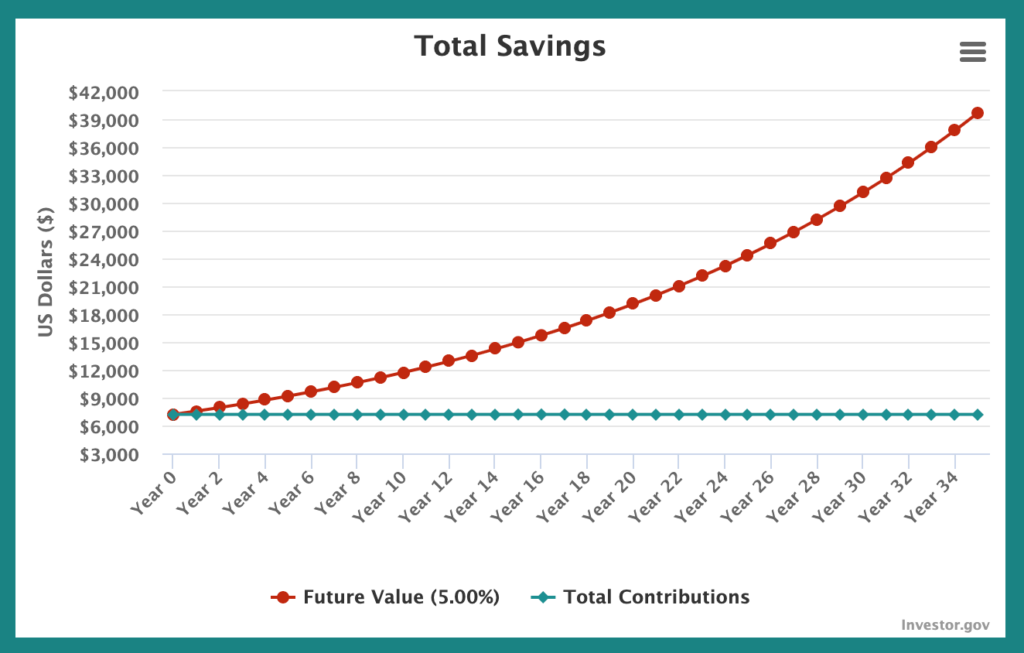

Here’s an Example: You have a baby in 2022. You pay the hospital bill of $3000, half of which is your deductible. In 2022 you also maxed out your HSA contribution at $7200. Great work! It sucks to pay a $3000 hospital bill, but you pay it now and hold onto the receipt. 35 years pass. Assuming a conservative 5% return, your HSA is now worth $39,715. That’s from just one year of contributions. The satisfying growth chart is below.

So, wait to submit the hospital bill for reimbursement, and spend the remaining $36,715 on margaritas. While you’re at it, submit the cost of your health care premiums, deductibles, and the post-partum Depends that were the best $10 you ever spent. Then, boat drinks. Perhaps on a boat. Perhaps on your boat!

$7200 Invested for 35 Years at 5%

What If I Need My HSA For Medical Expenses

To quote Spock, “What is necessary is never unwise.” You know your family’s medical situation best, and I support you fully in using your HSA as a medical savings account. Two things to consider:

Max it out and what you don’t need, invest. The EBRI noted that people with HSAs had an average balance of just $3,221 in 2019. You may have room to contribute more, get the tax savings on your medical expenses, and invest the rest

You don’t have to use it all for one thing. Both Optum and Fidelity allow you to invest as much or little as you want. So you can keep some in cash, and invest some. Trades aren’t taxed, so if a medical expense comes up, you can cash out of your invest ments.

Bonus! Did you know there is an HSA Store? This website allows you to spend money from your HSA on anything health-related. Some fun finds on the site include sunscreen, tampons, teeth whitening kits, breast pumps, and children’s medicine!

Join our AskFlossie community where all women are empowered with community and knowledge to build stronger financial lives. We’re here to be your financial wingwoman!