I am married to a currency collector. Specifically, a hottie who loves me, and hyperinflationary currencies and their histories. Zimbabwe, post-Soviet Eastern Bloc, and Argentina came up over our dinner table while I was working on my recent post on how to survive inflation. We’ve both seen a lot of US media terror right now about hyperinflation. “Hyperinflation 2022” is actually a trending search term. But it’s generally a lot of hype.

Generally, inflation is worse outside of the US. In some places, much worse. American economic conditions are so stable, that our perspective on inflation is… warped. Our inflation expectations are oriented to low inflation, low prices and monetary policy enacted by very competent people in recent years.

(Pundits can claim mismanagement all they want but members of the US Federal Reserve aren’t printing money to fund a war of aggression in the Congo.)

In this blogpost, we’re going to take a look at why you don’t need to worry about hyperinflation in 2022 if it comes up. For context on what economic mismanagement looks like, I’ve included some historical examples from three different countries.

Key Takeaways

- Several countries are seeing hyperinflation in 2022, but not the US

- Inflation and Hyperinflation are different – they have different causes and effects

- Hyperinflation has a notorious but fascinating history that taught us a lot about how to survive hyperinflation and see it coming

The technical definition of hyperinflation

So, what is hyperinflation? True hyperinflation is defined as a monthly inflation rate greater than 50%. It means that prices double every two months, and increase by a factor of 10x in a year.

In June 2022, annual inflation in the US was 9.1% and inflation expectations in the EU were also 8.6%. At that kind of inflation rate, prices double every eight and a half years.

That is a long way from hyperinflation.

Inflation Vs. Hyperinflation

Hyperinflation and inflation sound similar, but result in very different outcomes in the real world. With inflation, prices increase, but you can still buy things. In hyperinflation, the currency becomes worthless, and people go back to bartering, relying on foreign currency or maybe even using new currencies like Crypto.

Equilibrium and inflation

Equilibrium means price stability, when supply and demand get balanced. When this happens, it’s called a “natural” state because the market has an incentive to keep prices stable. Companies will want to sell their goods at lower costs to make more profit overall, while consumers will want to buy those same goods at lower costs so they can afford them. Neither side wants high interest rates!

Causes of inflation

While the economy of 2022 is a little different from prior downturns, (and very related to Russia’s invasion of Ukraine and fuel prices, a key risk) the causes of hyperinflation are fairly consistent throughout history. They tend to be isolated to a specific country, rather than the global inflationary pressures we’ve seen in the last year.

The main drivers of hyperinflation are:

- The government printing money, usually to fund government spending

- People lose faith in the currency. This is important because all currency is fiat money, meaning it’s not backed by gold. Faith in it matters a lot.

- There’s an external shock, like a world war or global pandemic

- Demand-pull inflation caused by supply chain issues

Increase in money supply (AKA the government printing money)

The government increases the money supply by creating more money, which decreases the value of each unit of currency. Prices start rising as the currency is devalued. If a lot of money is created, it can result in very high levels of inflation.

Historically, this has meant a government printing too much paper money, but today it generally means a central bank increases the base money supply in electronic financial markets.

Loss of faith in fiat money

Hyperinflation can also be caused by people’s lack of faith in a currency, or the government printing it. In the German Weimar Republic, as an example, people lost faith in the currency because of the government’s corruption and instability.

External supply shocks

An external shock, such as a war or a natural disaster, can also lead to hyperinflation. This is because the government may have to print more money to fund the emergency, and people may lose faith in the currency because of the instability. For instance, some of the inflation in Zimbabwe was caused by the government printing money to fund soldiers’ salaries.

Demand-pull inflation and supply bottlenecks

Another example of external supply shocks is the one we see right now: supply bottlenecks that result in demand-pull inflation. When there is a shortage of a product, the price for that product goes up because there are more people who want it than what is available. Economists call this “too many dollars chasing too few goods.”

Is the U.S. printing too much money?

You may have heard (finance) people say, “the government is printing a ton of money.” We are – relative to the U.S. But we’re not talking about paper currency: we’re talking about the Fed’s Balance Sheet or how much electronic money is available to be lent to banks.

Let’s look at those reserves over the last few years for context on how much to panic about high inflation. The biggest jump in the Fed Balance Sheet was in March 2020, in response to the pandemic, well before Biden was elected.

Recently, the Fed announced it will be drawing down its balance sheet, electronically erasing money. (USA Today has a pretty good fact check on “printing money” memes.)

The Federal Reserve uses monetary policy to keep high inflation under control in the United States and to balance fluctuations in the global economy. Avoiding high inflation while also avoiding a recession is the major goal of the Federal Reserve. It accomplishes this by limiting or expanding the quantity of money that can enter the market.

Is persistent inflation a problem in America?

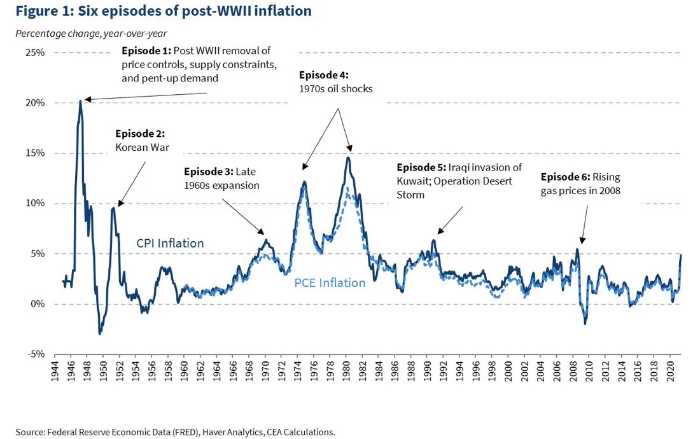

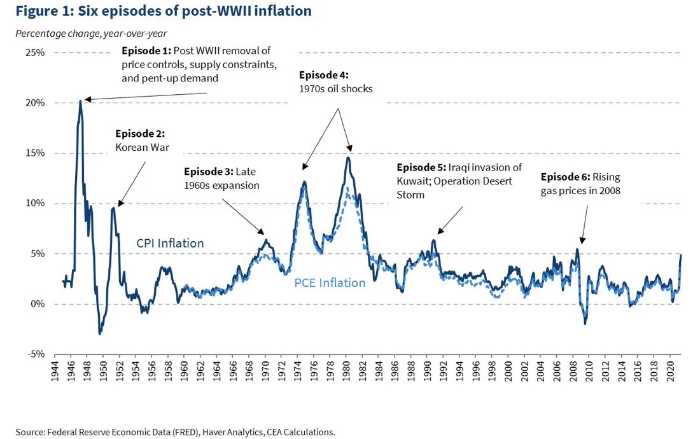

Not really. We’re not even a year into this thing. America has a recent history of low inflation, low interest rates and an extremely stable currency. 2.3% is the annual rate monetary authorities target and most people in the financial sector us as an assumption. The highest annual rate we have ever hit was 20%.

What are the effects of hyperinflation?

Hyperinflation impacts every part of the economy, and private life, dramatically.

The most visible is that people lose a lot of money very quickly. The prices of all goods and services increase at an accelerating pace, but people’s incomes and savings do not. This can be financially devastating. After the end of the Soviet Union, when currencies across the eastern block collapsed, not only did families see widespread shortages, their savings lost much or all value.

High consumer prices and hoarding

Higher prices lead to decreased purchasing power (people can’t buy as much with their money) and hoarding (people try to buy essentials before prices go up even more). This is why central banks worry so much about the Consumer Price Index (CPI), the core measure of inflation. Some governments introduce price controls.

This might not occur at an annual inflation rate of 10%, but at an annual inflation rate of 1000%, you are going to buy baby formula and pantry items before they are unaffordable.

Interest rates increase

Interest rates are also impacted by hyperinflation. In times of high inflation, people lose faith in the currency, and so they invest their money in other assets, such as gold or stocks, which offer a higher return. This drives up the price of those assets, and so interest rates also increase.

A shortage of goods

High prices –> hoarding –> shortages. We saw this famously with pandemic toilet paper and oil prices and shortages in the 70s, but price increases and shortages also mean businesses cannot get the supplies they need. This impacts entire supply chains.

Instability in financial markets and asset prices

Investors lose confidence in the currency and pull their money out of the market. Families lose their savings, and pensioners see the value of their retirement income decrease as mutual funds, stocks and other financial assets are devalued. Homes and other real estate may lose value as well.

Decrease in imports

Other countries will not accept the currency as payment, and so trade decreases. This can lead to even more shortages as domestic production cannot meet demand.

Riots and civil unrest

People are desperate and angry. They take to the streets. This can lead to a loss of faith in the government or a change in government.

Drop in tax revenues

Any government’s tax revenues depend on consumer spending and the prices of goods and services, and so the government collects much less tax with every tax increase under hyperinflation.

Some Notorious Histories of HyperInflation

As I mentioned, Hubs loves hyperinflationary currencies. Here are some of the interesting histories I have learned about from him.

Hyperinflation in VENEZUELA

Venezuela is the most recent instance of hyperinflation. In 2013, prices rose, and by 2018 inflation had reached 80,000%. How?

A mix of corruption, deficit spending, and a collapsing oil crisis, in a country where 25% of the GDP is exported oil. The official exchange rate was 10 bolivars to the dollar in 2013. Inflation levels doubled from 2013 to 2014 and by January 2019, it was 1,000,000 bolivars to the dollar. Due to the rapid drop in the value of the bolívar fuerte, Venezuelans jokingly called it “bolívar muerto” (“dead bolívar”).

The minimum wage in Venezuela dropped from about $360 per month in 2012 to $3.46 per month in 2019. Many Venezuelans fled to Colombia since the real value of their income, in the face of price increases, had fallen to a level they couldn’t live on. The Wall Street Journal reported that a teacher could only buy a dozen eggs and two pounds of cheese with a month’s wages. Thanks to a monthly inflation rate of nearly 60%, Venezuelans found themselves 1/100th of the purchasing power.

Venezuela’s annual inflation expectations for 2022 are 650%.

Hyperinflation in WEIMAR GERMANY

Weimar Germany experienced hyperinflation in the early 1920s, after the end of World War I. The Kaiser had bet a lot on winning World War I, but wound up with a huge reparations bill imposed by the Allies, as well as deficit spending to fund debts Germany incurred to pay for the war itself.

The Treaty of Versailles imposed a huge debt on Germany that could be paid only in gold or foreign currency. When the reparation debt came due, the German government printed money to buy the foreign currency required to pay them. This new money supply hit the market, the currency became worthless and prices skyrocketed.

A loaf of bread in Berlin that cost around 160 Marks at the end of 1922 cost 200,000,000,000 Marks by late 1923.

Hyperinflation reached its peak by November 1923 and ended when a new currency (the Rentenmark) was introduced. However, the political and economic instability contributed to the rise of Nazism in Germany. After World War II, the Allies chose not to impose excessive reparations, and instead took payments in machinery, manufacturing, intellectual property and labor.

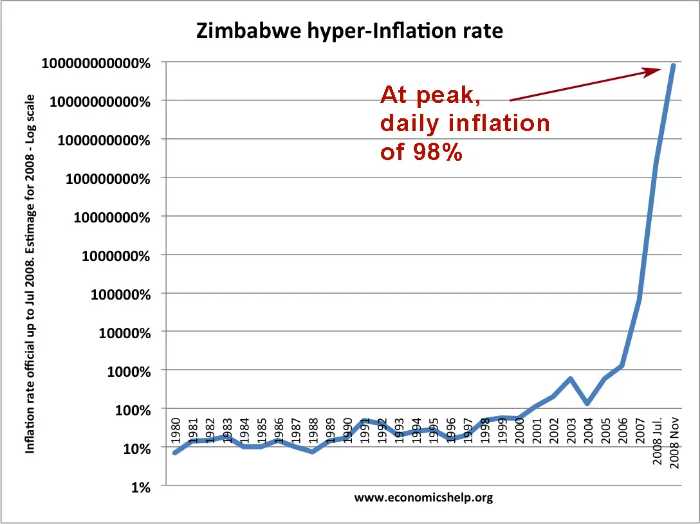

Hyperinflation in ZIMBABWE

In 2007, Zimbabwe saw an explosion of hyperinflation. It was caused by a mix of factors: drought, corruption, war. The government started printing money to pay for social programs, debt to the International Monetary Fund, and military aggression in Congo. With more money chasing the same amount of goods, prices went up.

Like Weimar Germany, as the currency became worthless, the government began flooding the money supply with bills with ridiculously high numbers on them. Fun fact: Zimbabwe used the same printmakers as the printed Weimar Republic.

Between gaining independence from the British in 1980 and 2000, annual inflation in Zimbabwe ranged from 7-57%, with a baseline inflation rate of about 10%. After 2000, it was north of 100% every year, and by 2006, it was above 1000%. Then the daily and monthly inflation rates exploded.

Finally, defeated by rising prices, the national bank stopped issuing the Zimbabwe dollar and relied on foreign currency for years. It was one of the episodes of highest inflation seen in modern times.

As of June 2022, inflation in Zimbabwe was 191%. While that isn’t hyperinflation, it’s a lot closer than the U.S. at 9.1% and the E.U. at 8.6%).

Hyperinflation in the US

Hayek Global College professor L. Burke Files says that hyperinflation is improbable in the United States, a stable economy, and because of cost-control features made available by a global economy.

According to Files, the ‘pressure relief valve’ for nations is the interconnected nature of the world.

Countries like Zimbabwe and Venezuela, whose central bank may print excessive amounts of money or attempt to manipulate their currency by restricting commerce, are the exceptions.