For many couples, joint finances are a smooth and convenient way to handle a shared life, but they also make separation more difficult, and provide a sad opportunity for identity theft and financial abuse. Learn how to protect yourself from identity theft when your relationship ends.

I’m sure your money is the last thing you want to think about right now. As a kid who grew up with a divorced single mom, I know there are actually more important things going on in your family and your life – surviving, healing, and figuring out the new world. I send you all the support of the AskFlossie community and share these tips so all women in your shoes are protected, with the least amount of fuss possible.

Secure and separate your accounts and finances before identity theft can occur – and stay alert of the risk for a year or more after you split. Here’s what you need to know:

Key Takeaways

- My number one piece of breakup advice: LOCK YOUR CREDIT

- Take these steps if your relationship is on the rocks or over and you want a clean financial break

- If you are still in a relationship and your spouse isn’t trustworthy with credit (e.g. they opened a credit card in your name) these tips can keep your score and identity safe

#1 Sign Up for an Identity Theft Protection Service

First and foremost, sign up for identity protection. I love my husband and trust him with my life, but if we separated, this is the first thing I would do. Your credit score stays with you for a long time. So does your kids’. I am really sorry you have to think about this right now. Here’s what to do:

How to lock and monitor your identity after a breakup

Several reputable companies offer affordable identity monitoring, but what does that really mean? Basically, they don’t let anyone drive your identity car. They will monitor your credit activity, financial accounts, and other known signs that your identity is being used without your knowledge or permission. If a new account is taken out in your name, or if there is strange activity, they will alert you and help you to take steps to protect your accounts and recover your funds.

I like and use Transunion for identity theft protection. Their credit freeze service is free and locks your Transunion credit score, which prevents new accounts in your name from being opened or getting a hard inquiry, which impacts your credit score. In fact, you can request a credit freeze from all three credit bureaus. Err on the side of caution here – separations and divorces can take many years, and it is better to force your separating partner to have a conversation with you, if it is going to impact your credit score after they are gone.

For a (not cheap) monthly fee, Transunion will also lock your Equifax score and send you notifications of any changes on your accounts. I’ve been a customer for a long time (they don’t pay me), and like their monitoring alerts. When I was single, it gave me a lot of peace of mind that no one was burning down my house while I wasn’t looking. Now that I am no longer single… it does the same!

Depressing fact: you can also freeze your child’s credit score with all three credit bureaus for similar reasons, until they are old enough to use it.

#2 Remove Authorized Users from Accounts

States differ in terms of how they handle marital property, but credit card companies have a universal concept called an “authorized user,” and this is how many married people hold credit cards. If your ex was an authorized user on an account you opened, now is the time to remove them. Consider every online account you have shared, including credit cards, online shopping (Amazon, Walmart, Instacart, etc), bank accounts, names on your credit cards, and even your emergency contact lists.

This will make it officially clear that your ex is no longer welcome to handle your personal or financial affairs. If they try after their name has been removed, it may create a flag in your identity theft monitoring.

#3 Change your beneficiaries

A little known nuance to financial accounts: the beneficiary you designate with your bank OVERRIDES your will or probate. So no matter if you dissolve your marriage, if your ex is still listed as a beneficiary on your banking documents, they get your money. Change it now. It’s super simple in all your banks online tools. You can change it again at any time. It’s really easy.

#4 CRANK Up Your Account Security Settings

Many women use low security settings because it makes life easier. But for the next year, crank up the security settings on your bank accounts, work account, and even your social media if you feel this may be necessary. Start using two factor authentication (where the app has to text you) and use FaceID whenever possible. Clear the cookies from your browser, and every time you log into an account, DECLINE “Remember this device.” While you’re at it, reset your device passcode. This is a pain in the butt, but once you get used to it, it gets pretty easy. To be honest, most software teams know passwords are kind of worthless, so they dreamt up texts, thumbprints and face-scanning to make it more secure, as well as less of a PITA.

#5 NEW Passwords FOR Every Account

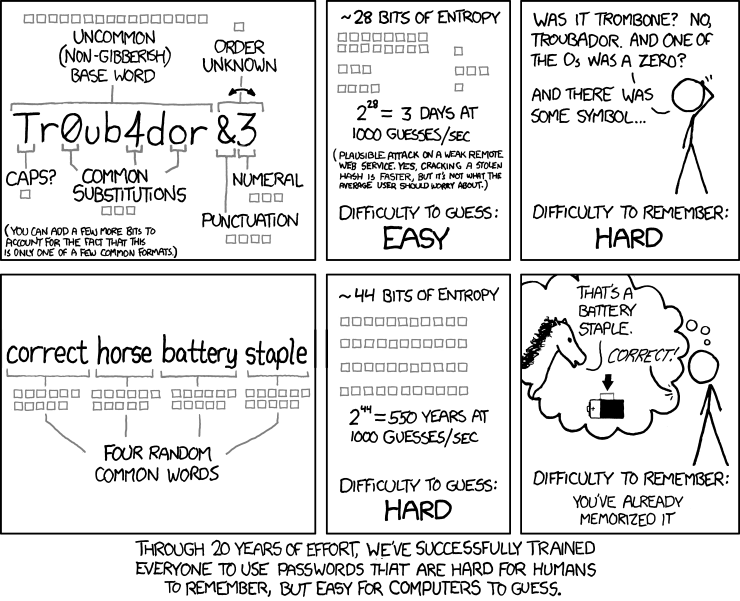

Sorry, this is the worst. Passwords are worthless, unless your ex knows them. Your ex likely knows your favorite default password and pin, may have your other passwords saved in their browser or phone. Change all of them. In fact, use your browser saved passwords as a guide for all the sites that need to be changed – but especially sites where you shop, manage money, or perform your job.

We advise building an entirely new set of passwords. Choose a funny theme and write short sentences to make the passwords both complex and easy to remember with humor. Swear words encouraged! Si usted habla varios idiomas, combínalos. Es un poder secreto.

#6 Open a New Bank Account & consider Transferring Funds and Direct Deposit

A new account and money moving between accounts could open a whole bag of worms with your ex, so tread carefully. At a minimum, take an inventory of what accounts you have and whether they are joint or in your name, and open a separate account for your paychecks and other income. Moving funds gets into legal territory, so it’s best not to make any big money moves without the advice of a lawyer.

Most importantly, keep an eye on account balances and your ex’s spending. This is a great time to take advantage of your bank’s notification settings. If you see any strange charges or large withdrawals, notify your bank, credit card company, and your attorney immediately.

Protecting your accounts and finances after separating from your partner is critical. While many exes may simply benefit from creating their own separate account, always be prepared in case your break-up turns to revenge spending, lunacy or worse.

Financial Wellness for Single Women

At AskFlossie, we are focused on helping women build financial security and wellness. Here are a couple of recent topics specific to single women.